CFD Strategies

Discover how you can grow your portfolio with a selection of CFD trading systems that allow profits to run whilst managing downside risk

CHOOSE FROM OUR RANGE OF CFD SYSTEMS BELOW

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

List of CFD Strategies

Navigate down the page using the buttons below to view each strategy.

1. PINNACLE 500

Pinnacle 500 trades CFDs on the S&P 500 contituents with an aggressive win:loss ratio

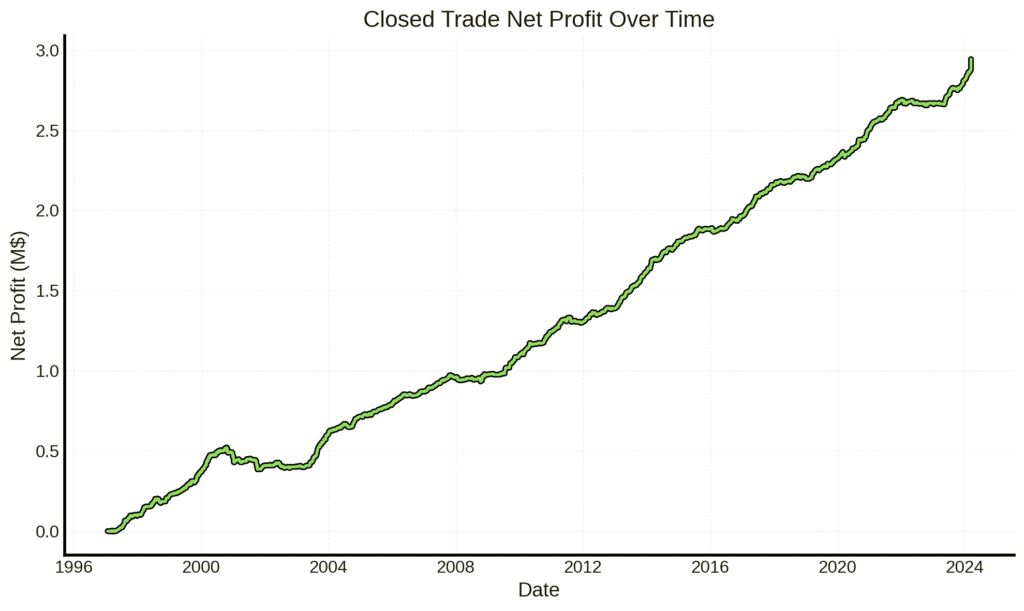

The Pinnacle 500 Strategy focuses on trading S&P 500 stock CFDs, employing assertive downside risk control while maximising gains in upward trends, particularly in bull markets. This approach aims for rapid entries in undervalued markets, with prompt exits in declining trends and adherence to bullish trends for exits. The strategy’s core principle is to swiftly cut losses while allowing profitable trades to flourish.

Tailored for bold CFD traders in search of a data-oriented approach prioritising risk management, the Pinnacle 500 Strategy simplifies daily trading choices. Interested in a disciplined trading strategy tailored to your needs? Discover how by clicking on “View Strategy”.

2. PINNACLE 400

Pinnacle 400 trades stock CFDs in the S&P Midcap index with profit running rules and risk management.

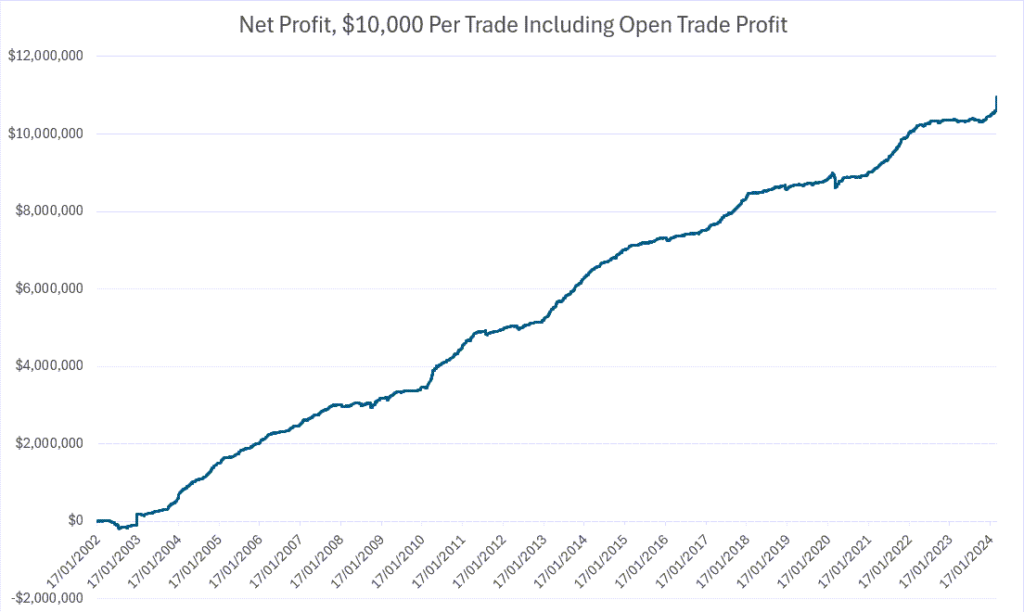

The Pinnacle Midcap 400 strategy focuses on amplifying successful trades and applying rigorous risk controls, particularly to limit losses. It aims to capitalise on market dips during upward trends or significant undervaluations during downtrends. The approach is to lock in profits quickly in declining markets, while in growth markets, it lets profits soar, especially when initiating trades near a mid-term trough.

Crafted for the proactive CFD trader in pursuit of a strategy built on analytical insights with a paramount focus on risk mitigation, the Pinnacle Midcap 400 System streamlines the need for frequent trading decisions. If you’re looking for a meticulously structured trading strategy to elevate your trading journey, click “View Strategy” to explore further.

3. PINNACLE 100

Entering during oversold markets Pinnacle 100 aggressively manages risk whilst letting profits run.

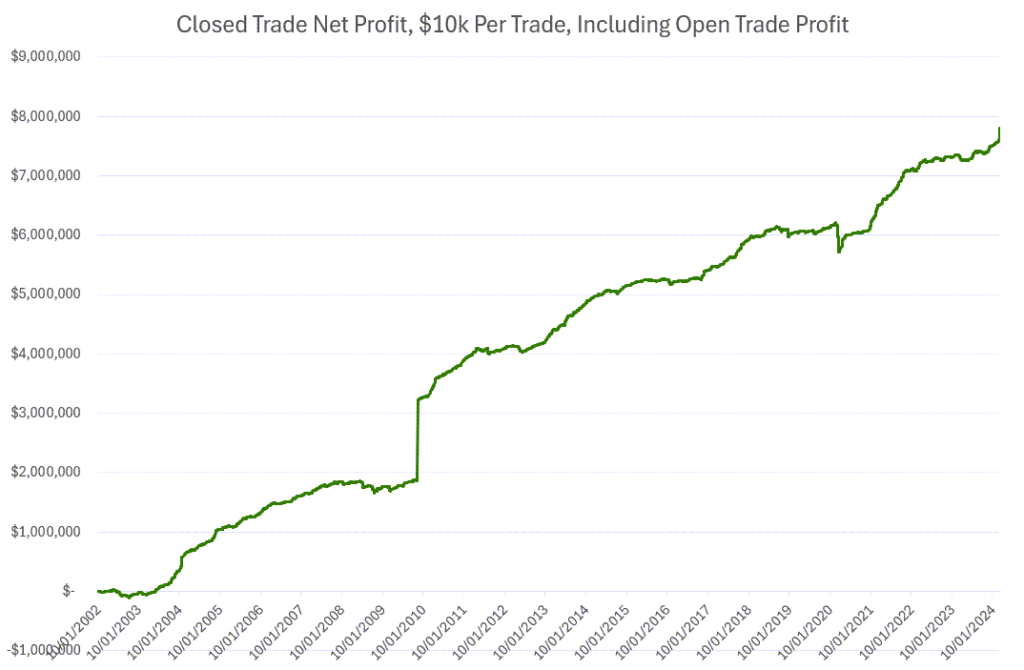

The Pinnacle 100 CFD System simplifies the process of trading stock CFDs within the Nasdaq 100 Index, targeting short to medium-term profits from markets that are oversold. By leveraging tools such as the RSI and ATR, it delineates precise entry and exit strategies for both rising and falling market scenarios. This automated strategy eases the trading process, with our agreement taking care of the execution of trades, thus reducing the workload on your part.

Tailored for the ambitious CFD trader in search of a strategy that’s grounded in solid data analysis and prioritises effective risk management, the Pinnacle 100 System aims to cut down on the number of trading decisions needed daily. If you’re in search of a meticulously organised trading strategy to enhance your trading, click “View Strategy” to learn more.