Futures Strategies

Adding a futures system to your portfolio can potentially help to increase returns in volatile environments such as bear markets.

CHOOSE FROM OUR RANGE OF FUTURES SYSTEMS BELOW

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

List of Strategies

Navigate down the page using the buttons below to view each strategy.

1. SWING 30

Introducing Swing 30: Overnight E-mini and Micro Trading for NASDAQ & S&P 500 Futures Contracts

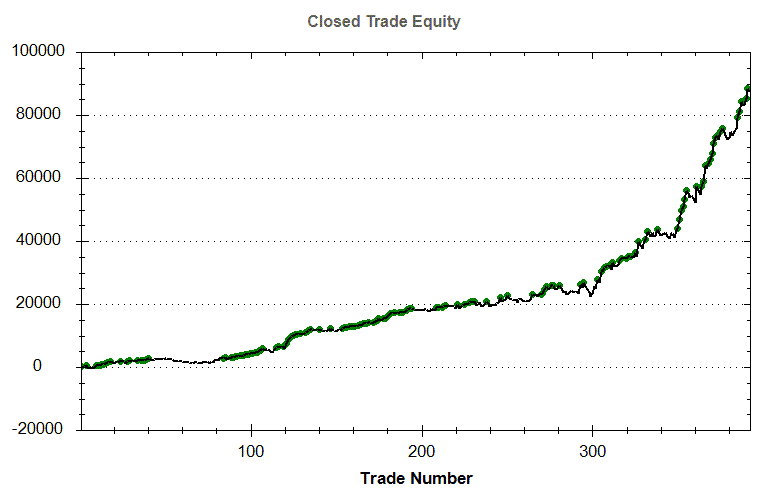

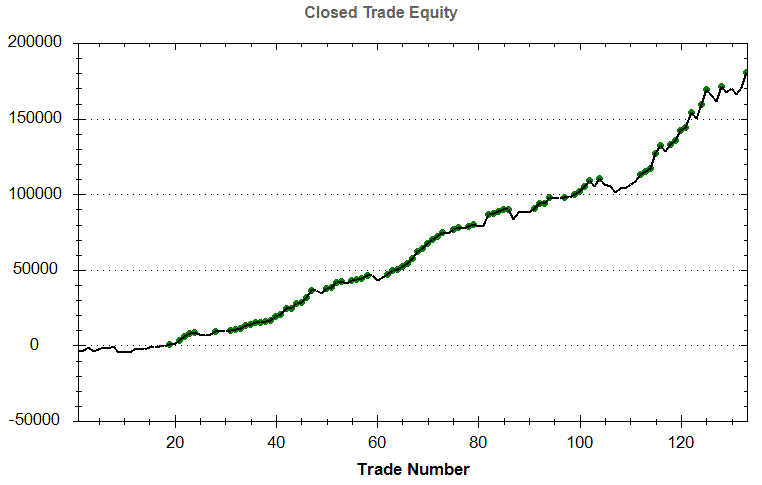

Discover the power of overnight trading with Swing 30, tailored for E-mini and Micro contracts on NASDAQ & S&P 500 futures markets. With a minimal capital requirement and robust risk management strategies, this system is designed to capture bullish moves over a time frame of a few days to a week. Don’t miss out on leveraging market movements to your advantage. Click the button below for more information on the Swing 30 Futures system. This system is an ideal complement to a stock portfolio requiring minimal capital outlay. The equity curve shows the closed trade results from trading one e-mini contract across a portfolio consisting of S&P500 and Nasdaq futures markets.

2. SWING 101

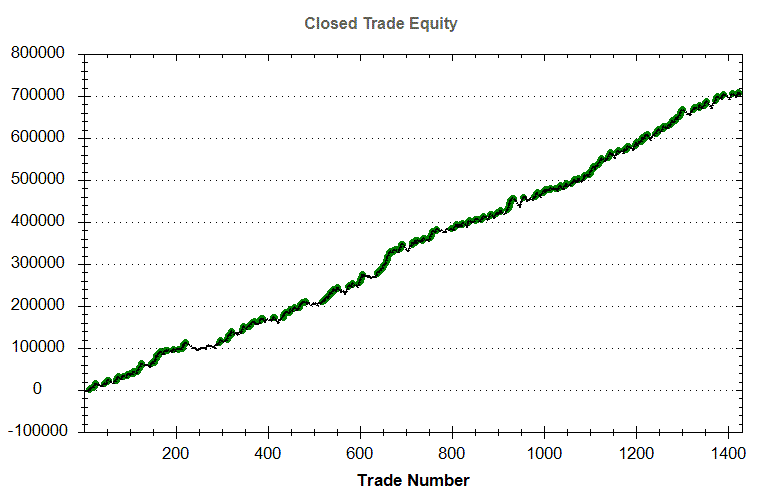

Pioneering E-mini S&P 500 Futures Trading System for trading Mini and Micro Contracts

The Swing 101 system is a groundbreaking futures swing trading solution for the S&P 500 emini or micro contracts, designed to excel in various market conditions. This versatile system serves as an excellent complement to a share portfolio, offering traders a sophisticated tool to enhance their market strategies and potentially increase profitability through well-analysed trades. The system is designed to capture short term moves to the upside with trend following exit rules on an intraday basis and a stop loss utilised for risk management. This system has been trading live since 2018 and a very good out of sample track record. Click View Strategy below.

3. DAYTRADE 21

Daytrade 21 is an E-mini S&P 500 day trading system with unique pattern filters and low correlation to other systems. Designed for dynamic market adaptation this system performs well in a volatile environment.

Daytrade 21 is a day trading system built for the S&P 500 e-mini futures market, leveraging unique pattern recognition with filters for adaptability. It stands out for its low correlation with other systems, offering traders diversified strategies. Since its launch, it has shown strong performance, ensuring it remains effective across different market conditions. This system provides a dynamic tool for traders looking to enhance their portfolio outcomes by potentially profiting during bear markets. For more information, please click the view strategy button below

4. VEGAS

Innovative E-mini (or Micro) S&P 500 Trading Strategy Leverages Seasonal Trends and Price Action for Swing Trading Success

S&P Vegas stands out for its strategic approach to trading. By concentrating on initiating trades around the middle of the month and targeting early exits in the subsequent month, it maintains a measured, not overly active trading rhythm. This system is ideal for those seeking to profit from market moves that unfold over several days to weeks, employing a sophisticated blend of price action analysis and insights into seasonal market trends. S&P Vegas not only identifies the most opportune moments for both entry and exit by leveraging historical data and predictable market cycles but also integrates a deep understanding of market price movements. This approach offers traders a comprehensive strategy that combines tactical foresight with analytical precision, aimed at maximising their positions in the market with a clear focus on timing and trends.

5. SWING 60

Introducing Swing 60: Overnight E-mini and Micro Trading for NASDAQ, DOW, S&P 500 Futures Contracts

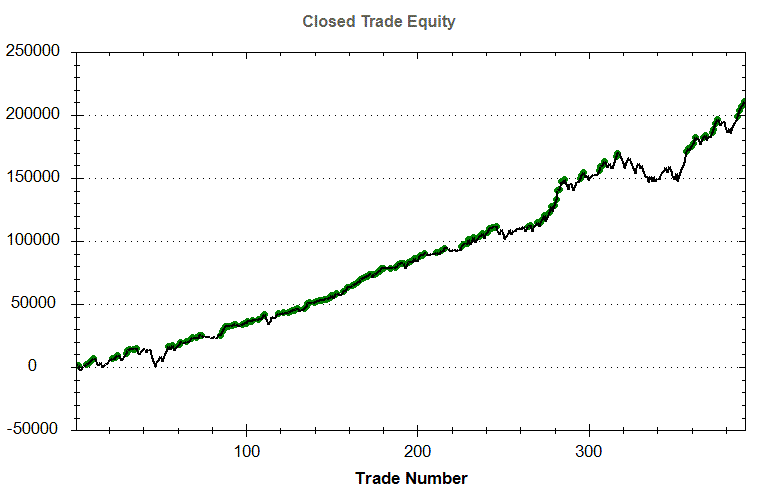

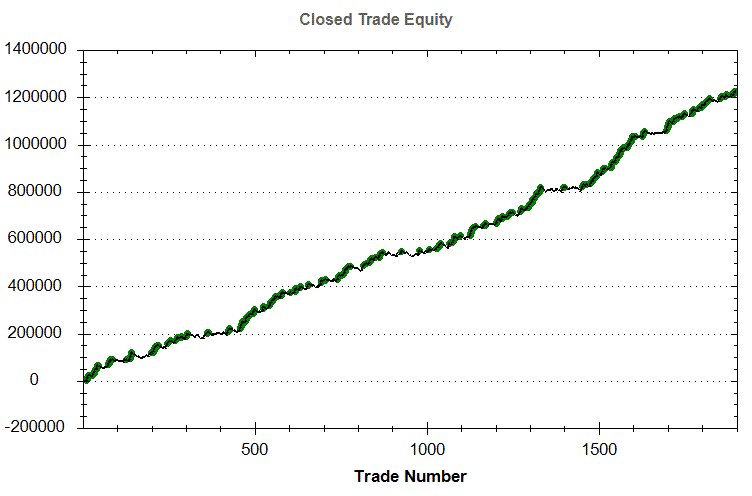

Explore the dynamic world of short-term trading with the Swing 60 system, specifically crafted for E-mini and Micro contracts across the DOW, NASDAQ, and S&P 500 futures markets. Operating on hourly data, this system unlocks the potential of overnight trades, allowing traders to capitalise on bullish trends spanning several days to a week. Designed with a low capital threshold and sophisticated risk management techniques, Swing 60 is poised to enhance your trading arsenal. By integrating this system, you benefit from an essential addition to your stock portfolio without significant financial commitment. The performance graph reflects consistent gains, demonstrating the system’s effectiveness through the successful trading of one e-mini contract in a diversified portfolio of Dow, S&P 500 and Nasdaq futures. For a deeper dive into how the Swing 60 Futures system can revolutionise your trading strategy, click the link below for further details.

6. BOUNCE

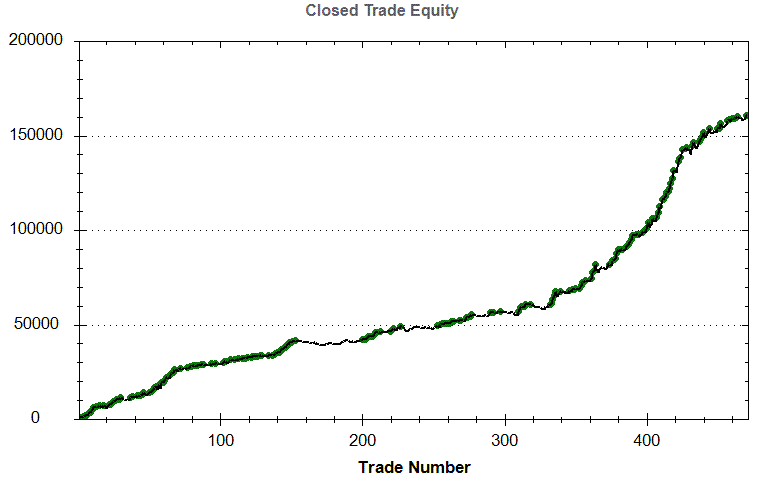

Bounce Trading System: Capitalising on Market Rebounds with Futures on Major Indexes Since 2004

Unlock the potential of your portfolio with the “Bounce” trading system, a proven strategy since 2004, designed to capture significant bullish rebounds across major indexes like S&P 500, Nasdaq, and Dow. Tailored for both Emini and micro contracts, this system offers a unique approach to diversify and enhance returns by seizing opportunities in market corrections. Experience the advantage of a system that’s built on robust analysis, offering a strategic edge in futures trading. For a deep dive into optimising your portfolio with “Bounce”, explore further details by clicking View Strategy.