ETF Strategies

ETF strategies can help you grow your account through the use of specialised systems designed to benefit from market biases.

CHOOSE FROM OUR RANGE OF ETF SYSTEMS BELOW

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

List of ETF Strategies

Navigate down the page using the buttons below to view each strategy.

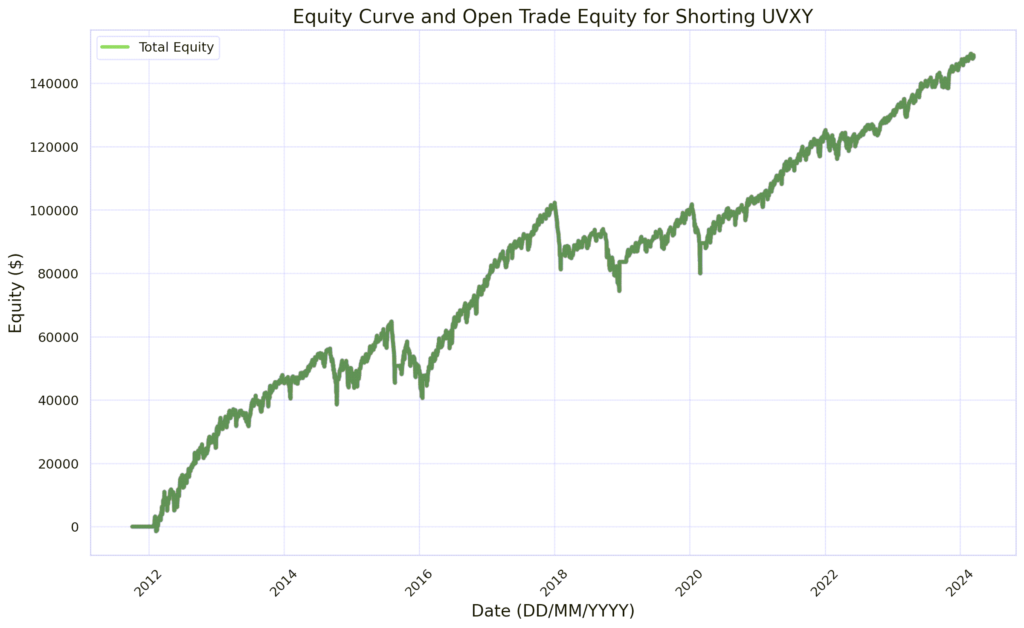

1. CONTANGO

Contango maintains a short position on the UVXY ETF which is rebalanced once a preset profit target is reached.

The Contango strategy, focusing on shorting UVXY with a modest portfolio percentage, showcases notable gains. This method, based on strategic entries and exits aligned with price action, leverages UVXY’s long-term decline due to its structural tendencies and volatility drag. The ascending equity curve evidences the strategy’s success, emphasising the need for precise trade management and rebalancing upon hitting profit goals. To mitigate risks associated with this complex, leveraged ETF, a cautious allocation of up to 5% of your portfolio is recommended.

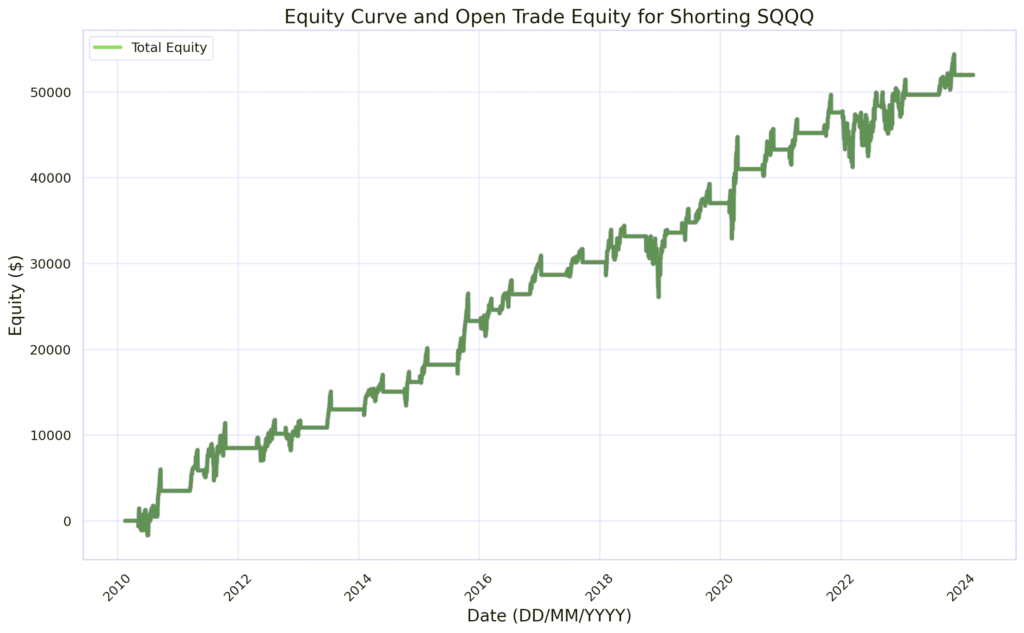

2. BOOSTER Q

Booster Q looks to short SQQQ during market pullbacks with strategic profit taking.

Booster Q targets market peaks by shorting SQQQ, employing wide stop losses and profit targets derived from the Average True Range (ATR). This method capitalizes on inverse ETF dynamics, aiming for gains that align with market volatility. Its effectiveness is showcased in the equity curve, marking sustained profits from strategic trade placements. This strategy offers a calculated blend of technical insight and risk control, ideal for navigating market fluctuations. For more information please click the View Strategy button below. An allocation of less than 10% of your account is suggested.