PINNACLE 100 CFD

Let your profits runs, cut your losses early! Trade Pinnacle, a mechanical system designed to buy low and sell high

SHORT TERM TREND FOLLOWING!

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Pinnacle 100 CFD Trading System

Pinnacle 100 is a system totally executed by MyTradingAdvisor on your trading account.

Our mission is to help our clients gain exposure to the stock market, without having to do any of the heavy lifting themselves. Best part – there are no joining fees and you can have the opportunity to have a professionally built strategy executed on your account.

1. Introducing Pinnacle 100

Pinnacle 100 is a relatively short term strategy that looks to enter during pull backs and sell-offs that seeks to cut losses early and let profits run.

The “Pinnacle 100 System” is a trading system designed for trading stock CFDs on the Nasdaq 100 Index with a focus on entering during oversold periods for short-term gain. The strategy is fully mechanical in nature with no discretionary inputs and as such can be executed on your behalf under the terms and conditions in our strategy execution agreement. This means that we handle the execution of the strategy for you, which means there is little day to day work on your part aside from monitoring your trades.

The system is a combination of two entry setups, one for when the market is in an uptrend and another entry setup for when the market is in a downtrend. The average trade length for the short-term component of the system is approximately one month, however the trend following component of the strategy can hold trades for several months or even over a year when trend conditions prevail.

This system employs a set of rules for entering and exiting trades, notably entry conditions which include distinguishing between bull market and bear market conditions, combined with entering trades when markets are heavily oversold.

| Pinnacle 100 | Details |

|---|---|

| Minimum Investment | US$12,500* |

| Market | Nasdaq 100 |

| Average Trade | 4.13% |

| Average Trade Length | 7 Weeks |

| Percentage Winning Trades | 51.5% |

| Win:Loss Ratio | 2.45 |

- Please note the minimum investment would be 3*leveraged i.e. 5 positions of US$7,500 for a face value of $37,500.

2. Why the Nasdaq 100 Stock CFDs?

The Nasdaq 100 Index is a premier stock market index that represents the performance of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. Known for its heavy emphasis on technology and innovation, the index includes a diverse range of companies from various sectors such as technology, retail, biotechnology, and healthcare. This makes the Nasdaq 100 not only a key barometer of the tech sector's health but also a reflection of broader innovation trends across the US economy. Constituents like Apple, Microsoft, Amazon, Alphabet, and Meta Platforms underscore the index's tech dominance, although its reach extends into other dynamic sectors, offering a comprehensive snapshot of contemporary corporate success and innovation.

KEY POINTS:

1

Broad Exposure to Innovation:

The Nasdaq 100 provides exposure to forefront companies driving technological advancement and market trends. Traders and investors gain access to a concentrated portfolio of high-growth potential stocks, encapsulating the pulse of innovation across various sectors.

2

VOLATILITY AND LIQUIDITY

Constituents of the Nasdaq 100 typically exhibit high volatility and liquidity, creating ample trading opportunities. The presence of major tech companies ensures active trading, enabling efficient entry and exit strategies for traders looking to capitalize on short-term movements or longer-term trends.

3

GROWTH POTENTIAL

The tech-heavy composition of the index often translates to higher growth prospects. Companies within the Nasdaq 100 are generally at the leading edge of technological advancements and market shifts, offering traders the potential for significant returns as these companies expand and evolve.

4

DIVERSIFICATION WITHIN HIGH GROWTH SECTORS

While the Nasdaq 100 is renowned for its focus on technology, the inclusion of companies from other innovative sectors allows for diversification. Traders can spread risk across different industries while maintaining a focus on growth-oriented stocks.

5

TRADING SHARES

Trading shares, compared with investing, is a more hands-on activity with daily or weekly monitoring of your account, which involves buying and selling with the aim to capitalize on shorter-term fluctuations. The purpose of trading is to generate income to supplement a primary source of income with the possible secondary goal of perhaps one-day trading for a living.

6

ADAPTABILITY TO MARKET TRENDS

The index is periodically reviewed and adjusted, ensuring it remains reflective of the leading non-financial companies on the Nasdaq. This adaptability means that the Nasdaq 100 evolves with the market, incorporating emerging leaders and shedding companies that fall behind, providing traders with a vehicle that aligns with current and emerging market trends.

3. Strategic Considerations

Engaging with the Nasdaq 100, through direct stock cfd trades, requires an understanding of the index's characteristics and the sectors it encompasses. The dominance of tech stocks means that shifts in technology trends or regulatory landscapes can significantly impact the index. Additionally, the high growth nature of these companies often comes with increased volatility and sensitivity to market dynamics, such as interest rate changes or economic shifts.

For traders, the Nasdaq 100 offers a blend of opportunity and challenge. The potential for substantial returns is counterbalanced by the need for vigilant risk management and an informed approach to market changes. Diversifying within the index’s constituents, staying abreast of technological and sector trends, and employing strategies that account for the inherent volatility can enhance the prospects for success.

Trading Tip: The Nasdaq 100 Index and its constituents represent a vibrant cross-section of modern industry leaders and innovators. For those looking to engage with the cutting edge of the market, trading within this index offers a pathway to tap into the growth, volatility, and transformative potential of some of the world’s most influential companies. With careful strategy and risk management, traders and investors can navigate the complexities of the Nasdaq 100 to potentially secure substantial gains.

4. What is the Pinnacle 100 Strategy:

The Pinnacle 100 strategy is a trading method designed to help traders make decisions on when to buy (or "go long" on) stocks within the Nasdaq 100 market, focusing on short-term opportunities. It uses a combination of technical analysis tools to identify potential entry points for buying stocks with the hope of selling them later at a higher price for profit. Let's break down the key components and rules of this strategy in simpler terms:

DATA INFO:

The strategy uses data from the Nasdaq 100 market, analysing both daily and weekly price movements of stocks within this index.

5. The Rules

The strategy consists of several rules for deciding when to buy (enter) or sell (exit) stocks. These rules are based on technical indicators, primarily focusing on the Average True Range indicator (ATR) and the Relative Strength Indicator (RSI).

- Bull Market Entry: This rule identifies buying opportunities within an uptrend when the market is temporarily oversold. It relies on the four period RSI falling below a lower thresold, to signal when prices have fallen to a level that may be considered oversold, whilst the stock remains in a longer-term uptrend defined by the lower Keltner band offering a strategic entry point for traders to capitalise on the resumption of the uptrend.

- Bear Market Entry: This rule triggers a buy signal when the closing price has been heavily sold off. It leverages the concept of countertrend trading, where entering the market during a sell-off can at times result in an entry at the beginning of a new bullish trend. This strategy comes into play when the closing price is below the lower Keltner Band when both the four period weekly RSI and four period daily RSI is below a lower threshold.

- Stop Loss: The stop loss for this system initiates when the lowest low in the trades is more than 3% from entry. If this condition is triggered, we set a target price at the lowest point in the trade plus 1.5 times Average True Range. When the close finishes above this level we exit on the following days open.

- Profit Target: This rule sets a target price to sell and take profits, calculated as the lowest price during the trade plus a multiple of average true range (ATR).

6. How it Works in Practice

Remember, while strategies like Pinnacle 100 can provide great trade setups, they're not foolproof. Market conditions can at times be unfavorable, and risk management is crucial. Always be prepared for the possibility of loss.

IDENTIFY OPPORTUNITY

Use the rules to find stocks that have hit a low point according to the strategy’s criteria.

ENTER THE TRADE:

Buy the stock when it meets the entry conditions.

SET PROFIT TARGET

Know in advance what the profit target is, based on the strategy’s profit target rule.

EXIT STRATEGY:

Sell the stock when it reaches the profit target or if any conditions suggest it’s time to exit to minimise losses.

LEVERAGE IS OPTIONAL

OUTSOURCE YOUR TRADE EXECUTION

This strategy is fully mechanical which allows you to outsource the management of the strategy on your account to MyTradingAdvisor. MTA will monitor the system on a day to day basis and execute the orders for the system on your account according to the terms and condition in the Strategy Execution Document.

7. Risk Management

When using the Pinnacle 100 strategy risk management should involve diversifying across a portfolio of 5-20 stocks. Diversification spreads the risk and reduces the volatility that can come from relying on the performance of a single or small group of stocks. The key is to select stocks that qualify under the Pinnacle 100 criteria from the Nasdaq 100 Index, which provides a wide array of high-growth potential companies.

By trading a carefully chosen set of 5-20 stocks, traders can manage their exposure to market fluctuations more effectively. This quantity is manageable for individual traders to monitor closely, ensuring they can react swiftly to the strategies indicators and market changes. The diversification within this range allows for the purchase of different companies, where the negative performance of one or a few stocks can be offset by gains in others.

Furthermore, this approach aligns with the principles of the Pinnacle 100 strategy, which capitalises on short-term market movements with trades lasting on average seven weeks. By having a diversified yet focused portfolio, traders can apply this strategy across multiple stocks, increasing their chances of capturing profitable trades without putting their entire investment at risk in one or two positions.

Overall, maintaining a portfolio of 5-20 stocks while using the Pinnacle 100 strategy is a practical approach to risk management. It enables traders to stay agile, making the most of the short-term trading opportunities that the Nasdaq 100 Index offers, while spreading their risk across multiple, carefully selected investments.

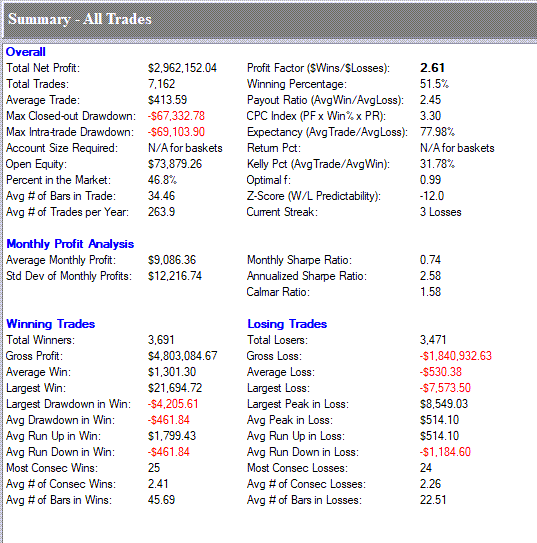

8. Strategy Statistics

The purpose of showing the performance summary for the Pinnacle 100 trading system is to analyse the results across the Nasdaq100 stock constituents as at the 28th of February 2024. The most important metrics are winning percentage, average trade, and payout ratio. As the performance report provides an aggregate measure for the results of trading across all stocks and taking every trade, it is useful for getting a gauge as to average profitability per trade and how much can be risked on a per trade basis.

In practice it would not be possible to take every single trade across all stocks as most accounts would not be large enough to handle more than 10-20 open trades at any one time, and as such numbers need to be analysed in this context.

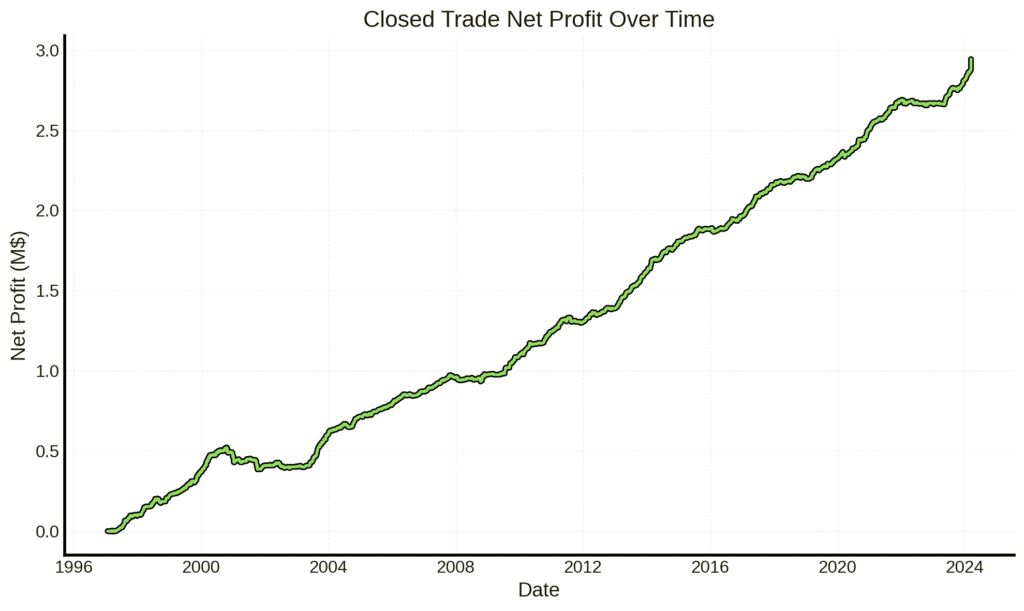

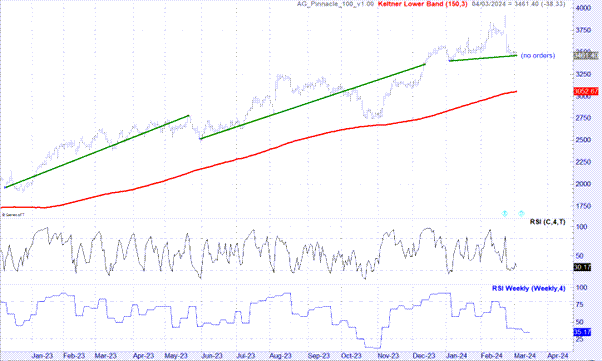

Closed Trade Equity Curve

The closed trade equity curve show the results for the Pinnacle 100 system rules if traded with a fixed US$10,000 per trade from January 1, 1997, to February 19, 2024, on the stocks in the Nasdaq 100 Index as at 28th February 2024.

OVERALL PERFORMANCE

- Assumptions: Trade Size: $10,000 per trade. All figures in USD.

- Number of Trades: All trades taken across all 100 stocks.

- Date Frame: 1st January 1997-29th February 2024.

- Total Net Profit: The profit after all wins and losses, totalling $2,962,152.04.

- Total Trades: The total number of trades made which is 7,162.

- Average Trade: The average profit or loss per trade, $413.59.

- Max Closed-out Drawdown: The largest peak-to-trough decline in the account balance assuming all trades taken, -$63,733.28.

- Max Intra-trade Drawdown: The largest drop in the position’s value of all trades, -$69,103.90.

- Open Equity: The unrealized profit/loss of open positions, $73,879.26.

- Percent in the Market: The percentage of time in the market, 46.8%.

- Avg # of Bars in Trade: The average number of trading days a trade is held, 34.46.

- # of Trades per Year: The average number of trading signals per year, 263.9.

MONTHLY PROFIT ANALYSIS

- Average Monthly Profit: The average profit made per month, $9,086.36 assuming all trades taken.

- Std Dev of Monthly Profits: The standard deviation of monthly profits, indicating volatility in monthly returns, $12,216.74 assuming all trades taken.

WINNING VS. LOSING TRADES

Winning Trades

- Total Winners: The total number of winning trades, 3,691.

- Gross Profit: The total profit from winning trades, $4,803,084.67.

- Average Win: The average profit of winning trades, $1,301.30 (13.01%).

- Largest Win: The largest profit from a single trade, $21,694.72 (216.9%).

- Largest Drawdown in Win: The largest drop in value before a winning trade was closed, -$4,205.61 (-42.05%).

- Avg Drawdown in Win: The average drop in value before a winning trade was closed, -$461.84 (-4.61%).

- Avg Run Up in Win: The average increase in value before a winning trade was closed, $1,799.43 (17.99%).

- Avg # of Bars in Wins: The average number of trading days a winning trade is held, 45.69.

Losing Trades

- Total Losers: The total number of losing trades, 3,471.

- Gross Loss: The total loss from losing trades, -$1,840,932.63.

- Average Loss: The average loss of losing trades, -$530.30.

- Largest Loss: The largest loss from a single trade, -$7,573.50 (75.73%).

- Largest Peak in Loss: The largest increase in value before a losing trade was closed, $8,549.03 (85.49%).

- Avg Peak in Loss: The average increase in value before a losing trade was closed, $514.10 (5.14%).

- Avg Run Up in Loss: The average increase in value of a trade before it turned into a loss, $514.10 (5.14%).

RISK METRICS

- Profit Factor (Wins/Losses): The ratio of total profit from winning trades to the total loss from losing trades, 2.61.

- Winning Percentage: The percentage of trades that are profitable, 51.5%.

- Payout Ratio (Avg Win/Avg Loss): The ratio of the average win to the average loss, 2.45.

- Kelly Pct (Avg Trade/Avg Win): The percentage of capital recommended for trade size according to the Kelly criterion, 31.78%.

- Optimal f: Another money management measure, 0.99.

- Monthly Sharpe Ratio: This is a measure of the risk-adjusted return of an investment. The Sharpe Ratio is calculated by taking the difference between the returns of the investment and the risk-free rate and dividing that by the standard deviation of the investment returns. A higher Sharpe Ratio indicates a better risk-adjusted return. The monthly Sharpe Ratio here is 0.74, which suggests that the investment has provided a return that is 0.74 times the standard deviation above the risk-free rate monthly.

- Annualised Sharpe Ratio: This is the Sharpe Ratio annualized for comparison over a longer period, which is 2.58 in this case. It’s a more comprehensive measure as it takes into account the compounding effect of monthly returns.

- Calmar Ratio: This ratio compares the average annual compounded rate of return and the maximum drawdown over the period. It is a measure of the investment’s performance relative to its risk, specifically the risk of significant losses. The Calmar Ratio is particularly relevant for hedge funds and other portfolios that aim for absolute returns. A higher Calmar Ratio indicates that the investment has a better return per unit of risk taken, as measured by the maximum drawdown. The Calmar Ratio here is 1.58, which implies that for every unit of risk as measured by the maximum drawdown, there has been a return of 1.58 units.

* Both Sharpe and Calmar ratios are useful for evaluating the performance of an investment by not just looking at the returns, but by considering the returns in relation to the risks taken to achieve those returns. The Sharpe Ratio is more generalised while the Calmar Ratio focuses specifically on drawdowns, which can be particularly important for understanding the downside risk.

SUMMARY

An analysis of the equity curve for this strategy shows it performs strongly in bull markets but does not lose heavily in bear markets. The periods from 2000-2003, 2007-2009 and 2021 to 2022 are periods where markets were in bear market territory.

9. Examples

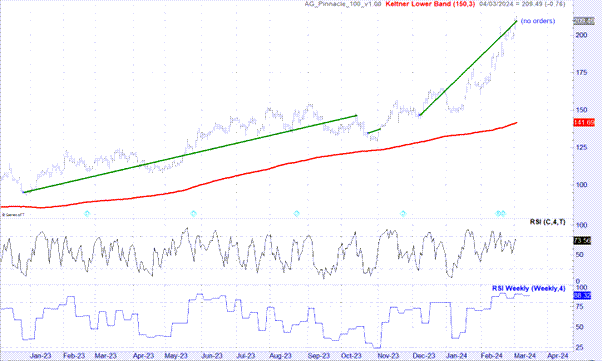

Trade Example#1 – Applied Materials (AMAT)

Trade #1

- Entry on the 27th of December 2022 at $95.14

- Exit on 13th of October 2023 at $146.49

- Result: Profit of $51.35 or 53.9%

Trade #2

- Entry on the 24th of October 2023 at $134.81

- Exit on the 2nd of November 2023 at $137.28

- Result: Profit of $2.47 or 1.83%

Trade #3

- Entry on the 7th of December 2024 at $146.71

- Current Position trading at $209.49 as at 4th March 2024

- Result: Open trade profit of $62.78 or 42.79%

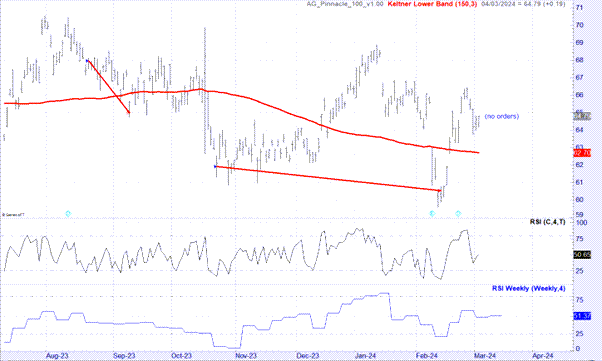

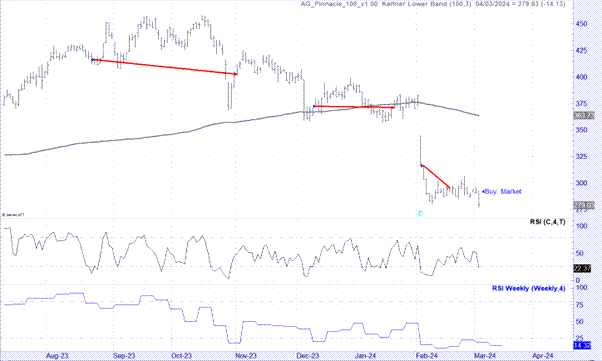

Trade Example#2 – Astra Zeneca (AZN)

Trade #1

- Entry on the 21st of August 2023 at $67.96

- Exit on the 11th of September 2023 at $64.98

- Result: Loss of $2.98 or 4.38%

Trade #2

- Entry on the 23rd October 2023 at $61.90

- Exit on the 13th February 2024 at $60.34

- Result: Loss of $1.56 or 2.52%

Trade Example#3 – Booking Holdings (BKNG)

Trade #1

- Entry on the 8th of December 2023 at $1962.39

- Exit on the 19th of May 2023 at $2780.97

- Result: Profit of $818.58 or 41.7%

Trade #2

- Entry on the 31st of May 2023 at $2516.77

- Exit on the 11th of December 2023 at $3287.65

- Result: Profit of $770.88 or 30.6%

Trade #3

- Entry on the 4th of January 2024 at $3400

- Current price as at 4th March 2024 $3461.79

- Open position profit of $61.79 or 1.8%

Trade Example#4 – Charter Communications (CHTR)

Trade #1

- Entry on the 23rd of August 2023 at $416.31

- Exit on the 1st of November 2023 at $402.85

- Result: Loss of $13.46 or -3.23%

Trade #2

- Entry on the11th of December 2023 at $372.59

- Exit on the 22nd of January 2023 at $371.10

- Result: Loss of $1.49 or -0.4%

Trade #3

- Entry on the 5th February 2024 at $316.11

- Exit on the 16th of February 2024 at $295.40

- Loss of $20.71 or -6.55%

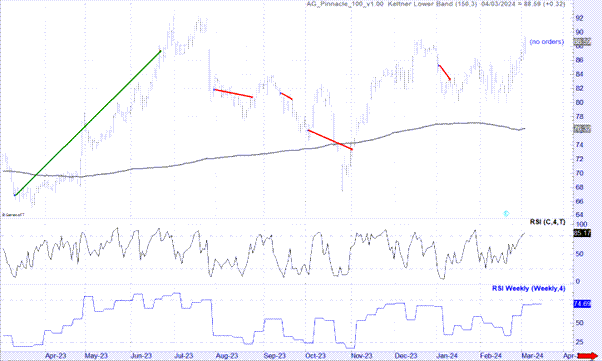

Trade Example#5 – CoStar Group (CSGP)

Trade #1

- Entry on the 13th of March 2023 at $66.85

- Exit on the 22nd of June 2023 at $87.35

- Result: Profit of $20.50 or 30.66%

Trade #2

- Entry on the 31st of July 2023 at $81.83

- Exit on the 24th of August 2023 at $80.78

- Result: Loss of $1.05 or 1.28%

Trade #3

- Entry on the 14th of September 2023 at $81.33

- Exit on the 21st of September 2023 at $80.50

- Result: Loss of -$0.83 or -1.02%

Trade #4

- Entry on the 3rd of October 2023 at $76.09

- Exit on the 1st of November 2023 at $73.38

- Result: Loss of $2.71 or -3.56%

Trade #5

- Entry on the 3rd of January 2024 at $85.25

- Exit on the 10th of January 2024 at $83.24

- Result: Loss of -$2.35 or -2.75%

TO PROCEED CLICK "SIGN UP NOW"

The Pinnacle 100 Strategy is a robust system, with the rules showing a strong historical positive expectancy. For traders seeking to amplify their investment portfolios this strategy is particularly enticing due to its strong performance metrics.

Investors interested in a disciplined and tested approach to trading, with clear historical evidence of success, should consider the Pinnacle 100 Strategy as a compelling option for their short-term trading endeavours. It’s an opportunity to participate in a robust strategy that has the potential to demonstrate resilience and profitability over time.

To have this strategy executed for you on your trading account please select the ‘Sign Up Now” button below to proceed. On the next page you will be asked for your name, email and phone number. We will check to see if you have an existing account, if so we will send you our Strategy Execution Agreement. If not we will help you to open an account with Interactive Brokers, which will be linked to MTA so we are able to execute trade on your account once funded.