SWING 60

Swing 60: A Futures Trading Strategy Aiming for Short-Term Profits in S&P 500 and Nasdaq E-mini & Micro Contracts

INDEX FUTURES TRADING SYSTEM

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Swing 60 Trading System

Swing 60 is a system totally executed and supervised by MyTradingAdvisor on your trading account.

Our mission is to help our clients gain exposure to the stock market, without having to do any of the heavy lifting themselves. Best part – there are no joining fees and you can have the opportunity to have a professionally built strategy executed on your account.

1. Introducing Swing 60

The Swing 60 System is a long-only, short-term index futures strategy focusing on capturing gains by entering positions during market uptrends, emphasising quick exits from losing trades and letting profitable trades run.

The “Swing 60 System” is designed for trading the Nasdaq 100 futures, targeting both e-mini and micro contracts. It embraces a long-only stance, aiming for a consistent equity curve and an advantageous win-loss ratio through the use of profit targets, stop losses, and breakeven stops. This strategy thrives on initiating trades during moments of market strength or breakouts, intended for short-term involvement.

Functioning as a fully automated system, Swing 60 operates independently of discretionary input, allowing it to be executed on clients’ behalf following a pre-agreed strategy execution contract. This approach significantly reduces the daily oversight required by the investor, limiting their involvement to simply monitoring their trades.

Distinguished as a perfect adjunct to stock portfolio strategies, Swing 60 offers low correlation and diversification advantages. With a focus on varied market conditions and timings—from brief trades lasting roughly a day to those extending up to a week—it provides a strategic equilibrium that bolsters overall portfolio durability. The detailed entry and exit protocols enhance the system’s attractiveness as a multifaceted investment solution, effortlessly melding with existing stock portfolios to maximise performance across different periods.

| Swing 60 System | E-Mini Contract | Micro Contract |

|---|---|---|

| Minimum Investment | US$70,500 | US$7,050 |

| Market | E-mini Futures | Micro Futures |

| Average Trade | US$479.31 | US$47.93 |

| Average Trade Length | 1-3 Days | 1-3 Days |

| Percentage Winning Trades | 46.31% | 46.31% |

| Win:Loss Ratio | 2.12 | 2.12 |

2. Why the Stock Index Futures?

The S&P and Nasdaq E-mini and Micro Futures are advanced financial instruments crafted to afford traders and investors of every scale—from individual retail traders to sizable institutional entities—a more approachable gateway into prominent US stock indices without necessitating a large capital investment. These tools are prized for their adaptability, liquidity, and the ability to customise investment size and risk exposure. E-mini contracts, which are reduced versions of standard futures contracts, together with the even smaller Micro Futures, facilitate meticulous portfolio management and speculative ventures. Their availability for trading round the clock allows market participants to swiftly adapt to global economic news, while the dependability and transparency provided by regulated exchange platforms enhance confidence in these markets.

KEY POINTS:

1

Scalable Investment Options:

E-mini and Micro Futures offer scalable investment opportunities for accessing major US indices, catering to a wide range of investment sizes and risk preferences.

2

Significant Liquidity:

These instruments ensure high liquidity, making it easier for traders to enter and exit positions efficiently.

3

Flexibility in Strategy:

Traders can employ both bullish and bearish strategies, providing the means to hedge existing investments or speculate on future market directions.

4

Extended Trading Hours:

The nearly 24/5 trading availability allows market participants to react promptly to international economic news and events.

5

Regulated Trading Environment:

Being traded on reputable, regulated exchanges, these futures contracts offer a secure and transparent environment for participants.

6

Lower Margin Requirements:

Compared to standard futures contracts, E-mini and Micro Futures have lower margin requirements, thus broadening access to index trading for more investors.

3. Strategic Considerations

S&P and Nasdaq E-mini and Micro Futures stand as sophisticated financial tools designed to enable traders and investors at all levels—from solo retail participants to large-scale institutional investors—to access key US stock indices in a more accessible manner, without the heavy capital requirements. These instruments are valued for their flexibility, market liquidity, and the opportunity to tailor the size of the investment and manage risk more effectively. E-mini contracts, scaled-down variants of traditional futures contracts, along with the smaller Micro Futures, support precise portfolio management and speculative activities. Their 24/7 trading availability empowers market participants to react promptly to international economic events, while the reliability and clarity offered by regulated trading venues bolster market confidence.

Risk management emerges as a crucial strategic aspect, especially considering the leverage involved in futures trading where minor market shifts can significantly impact portfolio performance. Implementing effective risk management techniques, such as placing stop-loss orders to cap potential losses, practising judicious position sizing to prevent overexposure, and diversifying among various asset classes to reduce risk, is essential. Additionally, the timing of trades—choosing when to buy or sell—should be carefully considered, aligning with one’s risk appetite and outlook on the market. Adopting a disciplined trading methodology, complete with explicit guidelines for initiating or closing trades, is key to maintaining focus and sidestepping decisions driven by emotion.

Trading Tip: Incorporating E-mini and Micro Futures into a wider investment strategy offers a prime opportunity for diversification and hedging. These instruments allow for exposure to the equity markets without the direct acquisition of shares, serving as a tool to hedge against declines in other portfolio assets or to speculate on market trends with reduced capital investment. The capability to take long and short positions adds a layer of flexibility, enabling traders to potentially benefit from both upward and downward market movements. By integrating these futures into a diversified investment approach, traders can bolster their portfolio’s defense against market fluctuations and seek out further avenues for growth.

4. What is the Swing 60 Strategy:

The Swing 60 Strategy represents a sophisticated approach to trading the Nasdaq 100 futures, applicable for both e-mini and micro contracts, underpinned by the advanced application of machine learning. This strategy utilises 60-minute intraday data, enabling the precise identification of prime entry moments during periods of market strength or breakout, with a long-only trading perspective. It is meticulously designed to capitalise on short-term market fluctuations, aiming to achieve a favourable win-loss ratio through the strategic use of profit targets, stop losses, and breakeven stops for risk management. What sets the Swing 60 Strategy apart is its foundation in machine learning algorithms, which analyse market price action and identify optimal entry and exit points.

DATA INFO:

The strategy uses data from the S&P500 and Nasdaq 100 intraday futures market, analysing 60 minute data of the full trading session.

5. The Rules

The Swing 60 Strategy, tailored for trading the Nasdaq 100 futures through e-mini and micro contracts, functions according to a specific set of guidelines for initiating and concluding trades. These rules, simplified from the original TradeStation Easy Language code, are outlined below:

Entry Rules:

- Time Window: Trades are initiated only within specific hours of the day to take advantage of the most liquid market periods, enhancing the efficacy of entry and exit strategies.

- Market Strength or Breakouts: The system engages in trades during times of market robustness or upon identifying a breakout. This determination is made through machine learning algorithms that scrutinise 60-minute intraday data for patterns indicating a likely surge in prices.

- Indicator Crosses: The crossing of certain technical indicators, which are mathematical evaluations based on price, volume, or open interest of a market, also influences entry decisions. These indicators are crucial for spotting trends and pivotal market shifts.

Exit Rules:

- Profit Targets and Stop Losses: To automatically conclude positions, the strategy employs set profit targets and stop losses. A profit target marks the specific level at which a trade is closed to capture gains, whereas a stop loss is established to curtail potential losses should the market trend unfavorably.

- Breakeven Stops: Should a trade advance favourably by a defined margin, a breakeven stop is triggered, adjusting the stop loss to the entry point. This ensures that a market reversal won’t convert the trade into a loss.

- Special Conditions Exit: The strategy also allows for trade exits under exceptional conditions identified by its machine learning component, signalling a substantial market turnaround or other risk factors that justify early loss mitigation or profit realisation.

Adhering to these rules facilitates a disciplined approach geared towards mitigating risk and optimising market opportunities. By sticking to these entry and exit criteria, the Swing 60 Strategy strives for a balance between securing gains and minimising losses, leveraging the predictive capacity of machine learning alongside strategic technical indicator use.

6. How it Works in Practice

Remember, while strategies like Swing 60 can provide great trade setups, they're not foolproof. Market conditions can at times be unfavorable, and risk management is crucial. Always be prepared for the possibility of loss.

IDENTIFY OPPORTUNITY

Use the rules to find stocks that have hit a low point according to the strategy’s criteria.

ENTER THE TRADE:

Buy the stock when it meets the entry conditions.

SET PROFIT TARGET

Know in advance what the profit target is, based on the strategy’s profit target rule.

EXIT STRATEGY:

Sell the stock when it reaches the profit target or if any conditions suggest it’s time to exit to minimise losses.

OUTSOURCE YOUR TRADE EXECUTION

This strategy is fully mechanical which allows you to outsource the management of the strategy on your account to MyTradingAdvisor. MTA will monitor the system on a day to day basis and execute the orders for the system on your account according to the terms and condition in the Strategy Execution Document.

7. Risk Management

In the realm of futures trading utilising the Swing 60 Strategy, risk management is paramount due to the significant leverage and volatility inherent in futures contracts. This strategy incorporates various crucial tactics to safeguard trading capital and manage risk effectively.

A cornerstone of this strategy is the application of stop-loss orders, a pivotal risk management instrument. These orders are set to automatically liquidate positions at pre-defined price levels should the market turn adverse to the trader’s position, thereby serving as a critical safeguard to preserve capital by averting substantial, unchecked losses.

Moreover, the strategy utilises profit targets and breakeven stops as means to both secure profits and further diminish risk. Profit targets enable traders to realise earnings at designated levels, whereas breakeven stops modify stop-loss orders to the entry price when a trade has benefitted the trader, ensuring protection against the erosion of accrued profits in case of a market downturn.

Lastly, the Swing 60 Strategy capitalises on machine learning algorithms to dissect market data for identifying prime entry and exit junctures. This analytics-based strategy improves the timing for engaging and disengaging from trades, curtailing the risk associated with entering or remaining in disadvantageous positions. By integrating these risk management practices, the Swing 60 Strategy strives to reduce losses, safeguard gains, and secure a favourable risk-reward balance for traders navigating the turbulent futures market.

8. Strategy Statistics

Comprehensive Trading Performance Analysis Report

This section provides an in-depth analysis of our trading system’s performance, showcasing metrics like net profit, risk assessment, and efficiency. It details the outcomes of trading strategies involving the Nasdaq 100 E-mini futures, emphasising profitability, drawdowns, and risk management. Through this report, traders can gain insights into the system’s effectiveness and make informed decisions.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Swing 60 Aggregate System Report

- 1 Contract Nasdaq 100 E-mini Swing 60 System Version 1 – Profit Target $2,500

- 1 Contract Nasdaq 100 E-mini Swing 60 System Version 1 – Profit Target $5,500.

- 1 Contract Nasdaq 100 E-mini Swing 60 System Version 2 with Profit Target $2,500.

- 1 Contract Nasdaq 100 E-mini Swing 60 System Version 2 with Profit Target $5,000.

- 1 Contract Nasdaq 100 E-mini Swing 60 System Version 2 with Profit Target $5,500.

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10. For instance, the maximum drawdown will be $2,122 ($21,220/10).

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

All 5 systems combined

Individual Market Performance Reports

The performance report above shows the portfolio performance for all 3 strategies. Below we show the system performance broken down into each individual market.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Swing 60 Nasdaq 100 E-mini System Report Profit Target 1

- 1 Contract Nasdaq100 Emini Swing 60 System

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Swing 60 Nasdaq 100 E-mini System Report with Profit Target 2

- 1 Contract Nasdaq 100 E-mini Swing 60 System with Profit Target 2

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Swing 60 Nasdaq 100 E-mini System Report with Profit Target 3

- 1 Contract Nasdaq 100 E-mini Swing 60 System with Profit Target 3

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Swing 60 Nasdaq 100 E-mini System Report with Profit Target 4

- 1 Contract Nasdaq 100 E-mini Swing 60 System with Profit Target 4

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Swing 60 Nasdaq 100 E-mini System Report with Profit Target 5

- 1 Contract Nasdaq 100 E-mini Swing 60 System with Profit Target 5

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

9. Examples

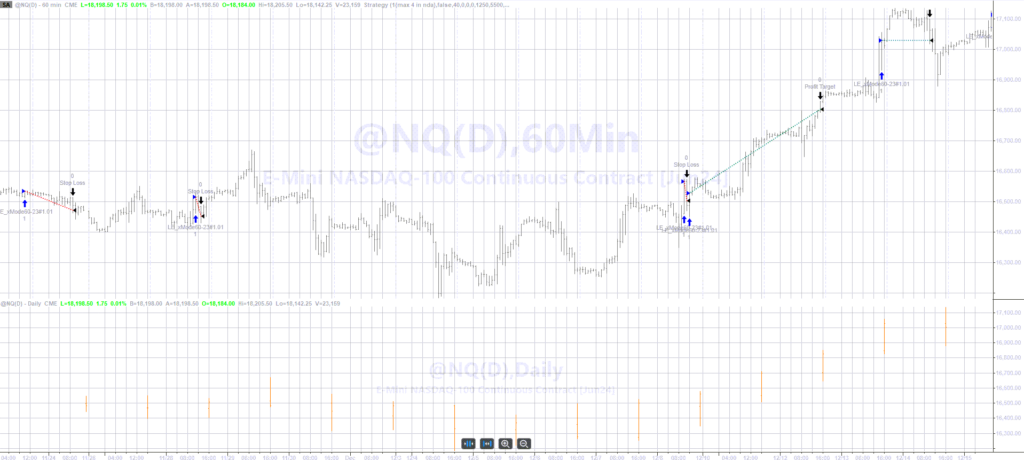

Nasdaq 100 E-Mini Contract Trade - Example 1

Nasdaq 100 E-Mini Contract Trade - Example 2

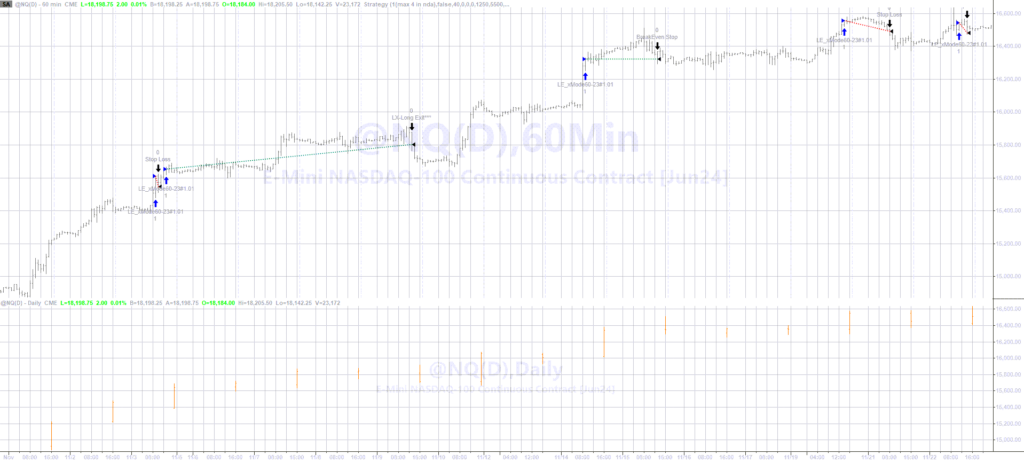

Nasdaq E-Mini Contract Trade - Example 3

Nasdaq E-Mini Contract Trade - Example 4

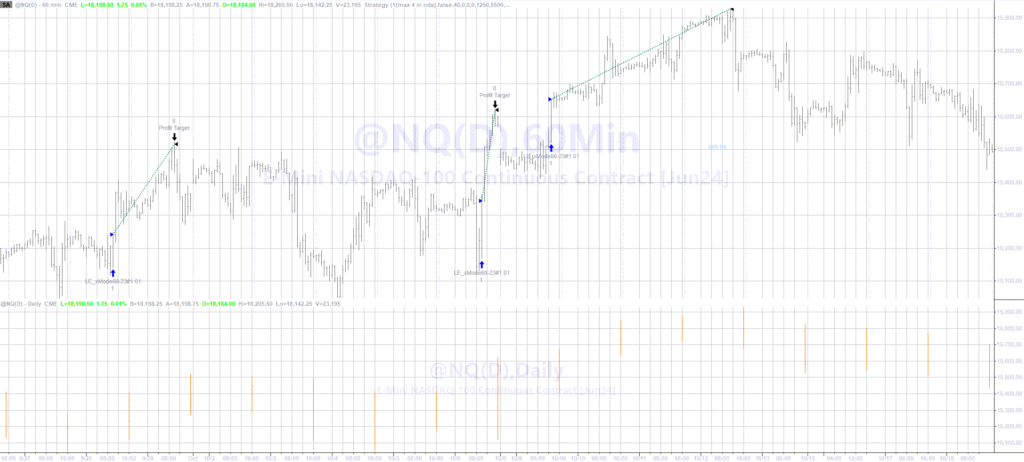

Nasdaq E-Mini Contract Trade - Example 5

TO PROCEED CLICK "SIGN UP NOW"

The Swing 60 Strategy is a robust system, with the rules showing a strong historical positive expectancy. For traders seeking to amplify their investment portfolios this strategy is particularly enticing due to its strong performance metrics.

Investors interested in a disciplined and tested approach to trading, with clear historical evidence of success, should consider the Swing 60 Strategy as a compelling option for their short-term trading endeavours. It’s an opportunity to participate in a robust strategy that has the potential to demonstrate resilience and profitability over time.

To have this strategy executed for you on your trading account please select the ‘Sign Up Now” button below to proceed. On the next page you will be asked for your name, email and phone number. We will check to see if you have an existing account, if so we will send you our Strategy Execution Agreement. If not we will help you to open an account with Interactive Brokers, which will be linked to MTA so we are able to execute trade on your account once funded.