DAYTRADE 21

Daytrade 21: A Day Trading System for Short-Term Profits in S&P 500 E-mini and Micro Futures

INDEX FUTURES DAY TRADING SYSTEM

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Daytrade 21 Trading System

Daytrade 21 is a system totally executed and supervised by MyTradingAdvisor on your trading account.

Our mission is to help our clients gain exposure to the stock market, without having to do any of the heavy lifting themselves. Best part – there are no joining fees and you can have the opportunity to have a professionally built strategy executed on your account.

1. Introducing Daytrade 21

Daytrade 21: A Versatile Day Trading Strategy for Both Bull and Bear Markets, Offering Long and Short Positions with Same-Day Exits. Thrives in Volatility and Maintains Low Correlation with Stock and Swing Trading Systems.

Daytrade 21 is a dynamic day trading system tailored for both bull and bear markets, leveraging the flexibility of trading S&P 500 e-mini and micro futures with both long and short positions. This strategy ensures that all positions are closed by the end of the trading day, making it exceptionally effective in volatile market conditions.

Additionally, Daytrade 21 exhibits a low correlation with traditional stock and futures swing systems, enhancing its utility as a diversification tool within investment portfolios. It operates under a clearly defined set of entry and exit rules, minimising the need for daily management and allowing investors to focus more on strategic oversight.

The system is designed to thrive in fluctuating market environments, offering a strategic balance that enhances overall portfolio resilience. By capitalising on different market conditions and timings—from short-term trades lasting about a day to potentially a week—Daytrade 21 seamlessly integrates with existing stock portfolios to optimise performance across varying timeframes.

| Daytrade 21 | E-Mini Contract | Micro Contract |

|---|---|---|

| Minimum Investment | US$70,500 | US$7,050 |

| Market | E-mini Futures | Micro Futures |

| Average Trade | US$479.31 | US$47.93 |

| Average Trade Length | 1-3 Days | 1-3 Days |

| Percentage Winning Trades | 46.31% | 46.31% |

| Win:Loss Ratio | 2.12 | 2.12 |

2. Why the Stock Index Futures?

The S&P and Nasdaq E-mini and Micro Futures represent innovative financial tools designed to offer traders and investors scalable access to leading US stock indices with reduced capital requirements. These instruments cater to a wide range of participants, from individual retail traders to institutional investors, by providing flexibility, liquidity, and the ability to tailor investment size and risk. E-mini contracts, scaled-down versions of standard futures contracts, along with even smaller Micro Futures, enable precise portfolio management and speculative opportunities. Their round-the-clock trading hours allow market participants to react swiftly to international economic developments, while the security and transparency offered by regulated exchanges add a layer of confidence in these markets.

KEY POINTS:

1

Scalable Investment Options:

E-mini and Micro Futures offer scalable investment opportunities for accessing major US indices, catering to a wide range of investment sizes and risk preferences.

2

Significant Liquidity:

These instruments ensure high liquidity, making it easier for traders to enter and exit positions efficiently.

3

Flexibility in Strategy:

Traders can employ both bullish and bearish strategies, providing the means to hedge existing investments or speculate on future market directions.

4

Extended Trading Hours:

The nearly 24/5 trading availability allows market participants to react promptly to international economic news and events.

5

Regulated Trading Environment:

Being traded on reputable, regulated exchanges, these futures contracts offer a secure and transparent environment for participants.

6

Lower Margin Requirements:

Compared to standard futures contracts, E-mini and Micro Futures have lower margin requirements, thus broadening access to index trading for more investors.

3. Strategic Considerations

When engaging in futures trading, particularly with instruments like the S&P and Nasdaq E-mini and Micro Futures, strategic considerations are paramount to navigating market volatility and managing risk effectively. A foundational strategy involves a deep understanding of market trends and economic indicators. Traders must remain vigilant to global economic developments, earnings reports, and geopolitical events that can influence market movements. Advanced technical analysis tools and market sentiment indicators can also provide valuable insights, helping traders anticipate potential market directions and adjust their positions accordingly.

Risk management is another critical strategic consideration. Given the inherent leverage in futures trading, small market movements can have amplified effects on portfolio performance. Effective risk management strategies include setting stop-loss orders to limit potential losses, employing proper position sizing to avoid overexposure, and diversifying across different asset classes to mitigate risk. Traders should also consider the timing of their trades, aligning entry and exit points with their risk tolerance and market outlook. Establishing a disciplined approach to trading, with clear rules for when to enter or exit a trade, helps in maintaining focus and avoiding emotional decision-making.

Trading Tip: Lastly, the integration of E-mini and Micro Futures into a broader investment portfolio presents a strategic opportunity for diversification and hedging. These instruments can be used to gain exposure to the equity markets without the need to directly purchase stocks, offering a way to hedge against downturns in other portfolio investments or to speculate on market movements with a smaller capital outlay. Additionally, the ability to trade long and short provides flexibility in responding to market conditions, allowing traders to potentially profit from both rising and falling markets. By incorporating these futures into a diversified investment strategy, traders can enhance portfolio resilience against market volatility while pursuing additional growth opportunities.

4. What is the Daytrade 21 Strategy:

The Daytrade 21 Strategy, an advanced system for trading S&P 500 futures, operates with both e-mini and micro contracts and incorporates cutting-edge machine learning technology. This strategy utilizes 30-minute intraday data to precisely pinpoint optimal entry points during periods of market strength or breakout scenarios, adopting a strategy that accommodates both long and short positions. It is expertly crafted to capitalise on short-term market movements, ensuring a favorable win-loss ratio through well-defined profit targets, stop losses, and breakeven stops for effective risk management. A key differentiator for Daytrade 21 is its reliance on sophisticated machine learning algorithms that meticulously analyse market price actions to determine the most advantageous entry and exit points. This technology-driven approach ensures that the strategy remains responsive and adaptive to changing market conditions, maximising potential returns while minimising risks. By leveraging state-of-the-art technology and a finely tuned trading strategy, Daytrade 21 stands out as a robust tool for traders aiming to exploit market volatility effectively. It offers a comprehensive and dynamic approach to day trading, making it a valuable addition to any trading portfolio looking to enhance performance through advanced, data-driven insights.

DATA INFO:

The strategy uses data from the S&P500 intraday futures market, analysing 30 minute data of the full trading session.

5. The Rules

The Daytrade 21 Strategy utilises a specific set of predefined rules for entering and exiting trades in the S&P 500 futures markets, focusing on e-mini and micro contracts. Below is a simplified explanation of these rules, translated from the provided TradeStation Easy Language code:

Entry Rules:

- Time Window: Trades are only initiated within a specified timeframe during the day, ensuring that the strategy capitalises on the most liquid market hours to maximise the efficiency of entry and exit points.

- Market Strength or Breakouts: The system looks to enter trades during periods of market strength or when a breakout is detected. This is determined using machine learning algorithms that analyse 30-minute intraday data, identifying patterns that suggest an imminent rise in prices.

- Indicator Crosses: Entry decisions are also based on the crossing of certain technical indicators, which are mathematical calculations based on the price, volume, or open interest of a market. These indicators help to identify trends and turning points.

Exit Rules:

- Profit Targets and Stop Losses: The strategy uses predefined profit targets and stop losses to automatically close positions. A profit target is a predetermined point at which a trade will be closed to secure profits, while a stop loss is set to limit potential losses if the market moves against the position.

- Breakeven Stops: Once a trade has moved in favor by a certain amount, a breakeven stop can be activated. This adjusts the stop loss to the entry price, ensuring that if the market reverses, the trade will not result in a loss.

- Special Conditions Exit: The strategy includes provisions for exiting trades based on special conditions detected by its machine learning component. These could be indicators of a significant market reversal or other risk factors that warrant cutting losses early or taking profits sooner than planned.

- End of Day Exit: Any open trades are closed at the end of the day.

Each of these rules contributes to a systematic approach designed to manage risk and capitalise on market opportunities efficiently. By adhering to these entry and exit parameters, the Daytrade 21 Strategy aims to maintain a balance between securing profits and limiting losses, based on the predictive power of machine learning and the strategic use of technical indicators.

6. How it Works in Practice

Remember, while strategies like Daytrade 21 can provide great trade setups, they're not foolproof. Market conditions can at times be unfavorable, and risk management is crucial. Always be prepared for the possibility of loss.

IDENTIFY OPPORTUNITY

Use the rules to find stocks that have hit a low point according to the strategy’s criteria.

ENTER THE TRADE:

Buy the stock when it meets the entry conditions.

SET PROFIT TARGET

Know in advance what the profit target is, based on the strategy’s profit target rule.

EXIT STRATEGY:

Sell the stock when it reaches the profit target or if any conditions suggest it’s time to exit to minimise losses.

OUTSOURCE YOUR TRADE EXECUTION

This strategy is fully mechanical which allows you to outsource the management of the strategy on your account to MyTradingAdvisor. MTA will monitor the system on a day to day basis and execute the orders for the system on your account according to the terms and condition in the Strategy Execution Document.

7. Risk Management

In the context of futures trading with the Daytrade 21 Strategy, risk management is paramount due to the significant leverage and inherent volatility of futures contracts. The strategy utilises several crucial mechanisms to safeguard trading capital and manage risk effectively.

A core component of the strategy is the use of stop-loss orders, an essential risk management tool. These orders help cap potential losses by automatically closing positions at preset price levels should the market move against the trader’s position. This feature is critical for preserving capital by preventing substantial, uncontrolled losses.

Additionally, the strategy includes profit targets and breakeven stops to both secure gains and further mitigate risk. Profit targets enable traders to lock in profits at designated levels, whereas breakeven stops adjust stop-loss orders to the trade’s entry price once the market moves favourably, thus protecting against the loss of accrued profits if the market reverses.

Finally, Daytrade 21 employs advanced machine learning algorithms to analyse market data and identify optimal entry and exit points. This data-driven approach enhances the timing of trades, minimising the risk associated with entering or remaining in disadvantageous positions. By integrating these sophisticated risk management techniques, Daytrade 21 aims to minimise losses, safeguard gains, and maintain a favourable risk-reward ratio in the challenging environment of the futures market.

8. Strategy Statistics

Comprehensive Trading Performance Analysis Report

This section provides an in-depth analysis of our trading system’s performance, showcasing metrics like net profit, risk assessment, and efficiency. It details the outcomes of trading strategies involving the S&P 500 E-mini futures, emphasising profitability, drawdowns, and risk management. Through this report, traders can gain insights into the system’s effectiveness and make informed decisions.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Daytrade 21 System Report

- 1 Contract S&P 500 E-mini System

OVERALL PERFORMANCE SUMMARY

- Assumptions: 1 contract each per trade on the S&P500 Emini contract.

- Total Net Profit: $160,807 – Net earnings after subtracting losses.

- Max Drawdown: $4,335 – Largest decrease in account value, indicating risk level.

- Gross Profit: $248,552 – Total from winning trades.

- Gross Loss: $87,745 – Total from losing trades.

- Profit Factor: 2.83 – Efficiency of the strategy, where greater than 1 is profitable.

- Pessimistic RR: 2.47 – Measures risk-reward balance, higher is better.

- Total Trades: 471 – Total number of trades executed.

- % Profitable: 64.12% – Percentage of trades that were profitable.

- Avg. Trade Net Profit: $341 – Average net profit per trade.

- Max Intraday Drawdown: $5,085 – Largest same-day loss.

- Recovery Factor: 37.1 – Effectiveness of the strategy to recover from drawdowns.

- Sharpe Ratio: 0.564 – Measures risk-adjusted return, higher is better.

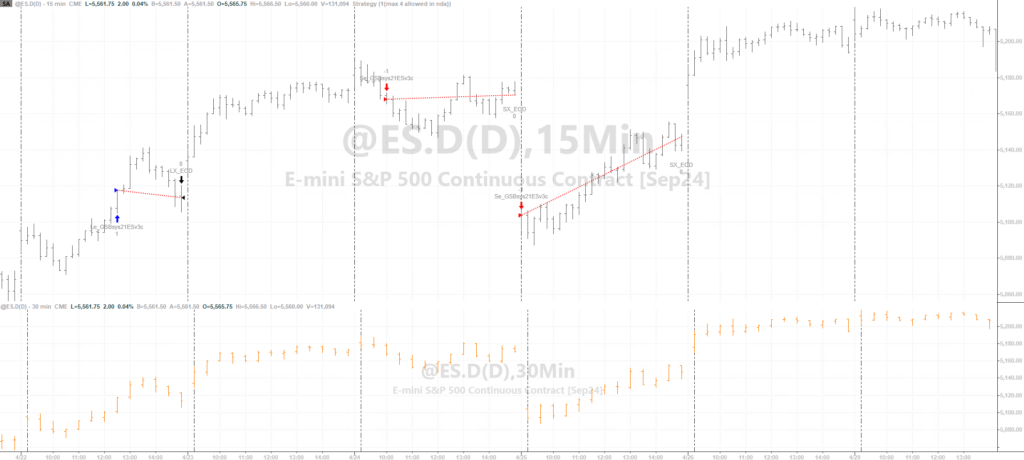

9. Examples

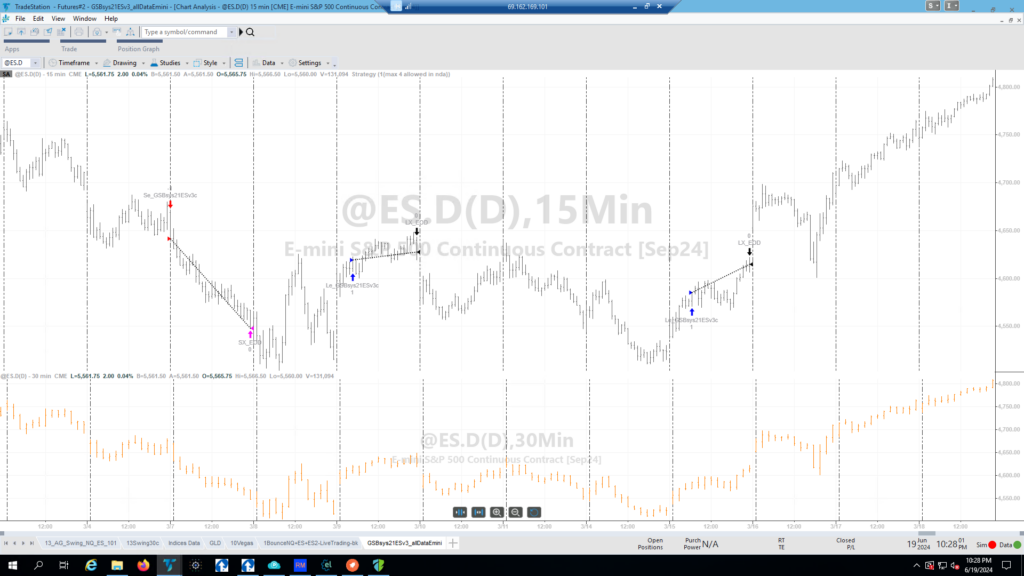

S&P E-Mini Contract Trade - Example 1

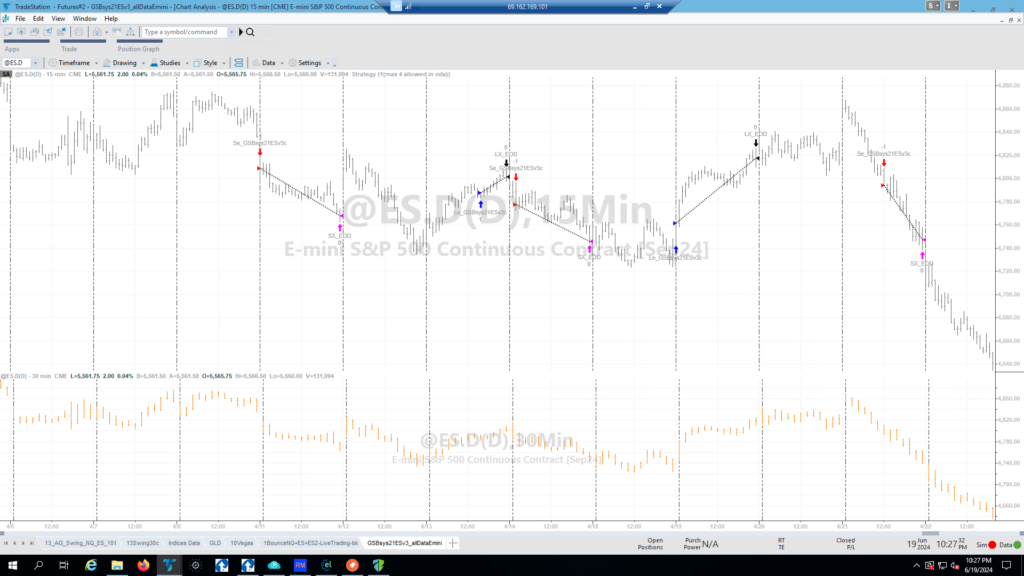

S&P E-Mini Contract Trade - Example 2

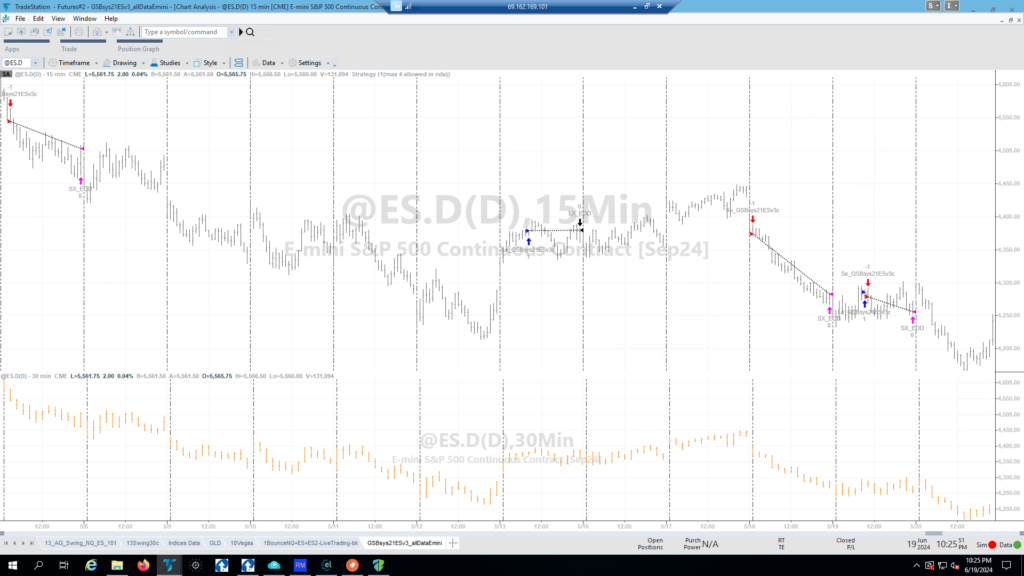

S&P E-Mini Contract Trade - Example 3

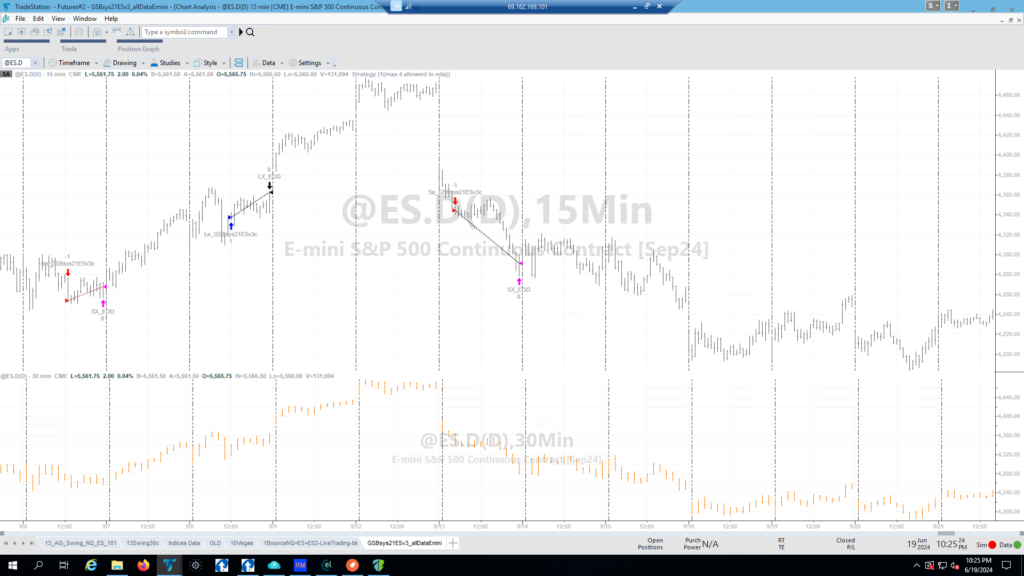

Nasdaq E-Mini Contract Trade - Example 4

Nasdaq E-Mini Contract Trade - Example 5

TO PROCEED CLICK "SIGN UP NOW"

The Daytrade 21 Strategy is a robust system, with the rules showing a strong historical positive expectancy. For traders seeking to amplify their investment portfolios this strategy is particularly enticing due to its strong performance metrics.

Investors interested in a disciplined and tested approach to trading, with clear historical evidence of success, should consider the Daytrade 21 Strategy as a compelling option for their short-term trading endeavours. It’s an opportunity to participate in a robust strategy that has the potential to demonstrate resilience and profitability over time.

To have this strategy executed for you on your trading account please select the ‘Sign Up Now” button below to proceed. On the next page you will be asked for your name, email and phone number. We will check to see if you have an existing account, if so we will send you our Strategy Execution Agreement. If not we will help you to open an account with Interactive Brokers, which will be linked to MTA so we are able to execute trade on your account once funded.