BOUNCE

A Futures Trading Strategy that Seeks Short-Term Gains Across Multiple Global Indices Including S&P 500, Nasdaq, Russell and Dow

INDEX FUTURES DAY TRADING SYSTEM

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Bounce Trading System

Bounce is a system totally executed and supervised by MyTradingAdvisor on your trading account.

Our mission is to help our clients gain exposure to the stock market, without having to do any of the heavy lifting themselves. Best part – there are no joining fees and you can have the opportunity to have a professionally built strategy executed on your account.

1. Introducing Bounce

Bounce System: Day Trading Strategy Targets Rapid Rebounds in Indices Like S&P 500 and Nasdaq, Leveraging Strong Counter-Trend Reversals for Short-Term Profits

Bounce System: A Comprehensive Day Trading Strategy for Index Futures, Concentrating on E-Mini and Micro Contracts. This Long-Only, Fully Automated System Leverages Market Rebounds for Quick Gains, Structured to Maintain a Consistent Equity Curve and an Advantageous Win-Loss Ratio Through Precise Risk Management Including Set Profit Targets, Stop Losses, and Breakeven Stops.

It requires minimal daily oversight, allowing investors to focus on broader portfolio management. The Bounce System is designed to complement existing stock portfolios by providing diversification and reducing correlation risks. It operates under a strict predefined execution agreement, ideally suited for short-term trades that typically last for up to one day, thus offering a strategic balance to enhance portfolio resilience across various market conditions. This system is crafted to integrate smoothly with other investment strategies, optimising performance over different trading periods and market scenarios.

| Bounce System | E-Mini Contract | Micro Contract |

|---|---|---|

| Minimum Investment | US$70,500 | US$7,050 |

| Market | E-mini Futures | Micro Futures |

| Average Trade | US$479.31 | US$47.93 |

| Average Trade Length | 1-3 Days | 1-3 Days |

| Percentage Winning Trades | 46.31% | 46.31% |

| Win:Loss Ratio | 2.12 | 2.12 |

2. Why the Stock Index Futures?

The S&P and Nasdaq E-mini and Micro Futures represent innovative financial tools designed to offer traders and investors scalable access to leading US stock indices with reduced capital requirements. These instruments cater to a wide range of participants, from individual retail traders to institutional investors, by providing flexibility, liquidity, and the ability to tailor investment size and risk. E-mini contracts, scaled-down versions of standard futures contracts, along with even smaller Micro Futures, enable precise portfolio management and speculative opportunities. Their round-the-clock trading hours allow market participants to react swiftly to international economic developments, while the security and transparency offered by regulated exchanges add a layer of confidence in these markets.

KEY POINTS:

1

Scalable Investment Options:

E-mini and Micro Futures offer scalable investment opportunities for accessing major US indices, catering to a wide range of investment sizes and risk preferences.

2

Significant Liquidity:

These instruments ensure high liquidity, making it easier for traders to enter and exit positions efficiently.

3

Flexibility in Strategy:

Traders can employ both bullish and bearish strategies, providing the means to hedge existing investments or speculate on future market directions.

4

Extended Trading Hours:

The nearly 24/5 trading availability allows market participants to react promptly to international economic news and events.

5

Regulated Trading Environment:

Being traded on reputable, regulated exchanges, these futures contracts offer a secure and transparent environment for participants.

6

Lower Margin Requirements:

Compared to standard futures contracts, E-mini and Micro Futures have lower margin requirements, thus broadening access to index trading for more investors.

3. Strategic Considerations

When engaging in futures trading, particularly with instruments like the S&P and Nasdaq E-mini and Micro Futures, strategic considerations are paramount to navigating market volatility and managing risk effectively. A foundational strategy involves a deep understanding of market trends and economic indicators. Traders must remain vigilant to global economic developments, earnings reports, and geopolitical events that can influence market movements. Advanced technical analysis tools and market sentiment indicators can also provide valuable insights, helping traders anticipate potential market directions and adjust their positions accordingly.

Risk management is another critical strategic consideration. Given the inherent leverage in futures trading, small market movements can have amplified effects on portfolio performance. Effective risk management strategies include setting stop-loss orders to limit potential losses, employing proper position sizing to avoid overexposure, and diversifying across different asset classes to mitigate risk. Traders should also consider the timing of their trades, aligning entry and exit points with their risk tolerance and market outlook. Establishing a disciplined approach to trading, with clear rules for when to enter or exit a trade, helps in maintaining focus and avoiding emotional decision-making.

Trading Tip: Lastly, the integration of E-mini and Micro Futures into a broader investment portfolio presents a strategic opportunity for diversification and hedging. These instruments can be used to gain exposure to the equity markets without the need to directly purchase stocks, offering a way to hedge against downturns in other portfolio investments or to speculate on market movements with a smaller capital outlay. Additionally, the ability to trade long and short provides flexibility in responding to market conditions, allowing traders to potentially profit from both rising and falling markets. By incorporating these futures into a diversified investment strategy, traders can enhance portfolio resilience against market volatility while pursuing additional growth opportunities.

4. What is the Bounce Strategy:

An Advanced Day Trading Strategy for S&P 500 and DAX Futures, Specialising in E-Mini and Micro Contracts. This Fully Automated, Long-Only System Targets Rapid Gains by Exploiting Strong Counter-Trend Rebounds During Single Trading Sessions. It Preserves a Consistent Equity Curve with an Optimal Win-Loss Ratio through Strategic Risk Management, Including Fixed Profit Targets and Stop Losses. Designed for Minimal Active Management, it Operates on a Predetermined Execution Agreement, Making it Ideal for Investors Who Prefer to Minimize Daily Oversight Yet Seek to Maximise Short-Term Trading Opportunities.

DATA INFO:

The strategy uses data from the S&P500 and Nasdaq 100 intraday futures market, analysing intraday data of the full trading session.

5. The Rules

This strategy employs e-mini and micro contracts, adhering to a set of predefined rules for entering and exiting trades based on specific market conditions. The rules are laid out in a user-friendly format, derived from the TradeStation Easy Language code, ensuring traders can easily understand and implement them. This makes the Bounce System ideal for traders looking for clear, concise guidelines for short-term market engagement within a single trading session.

Entry Rules:

- Time Window: Trades are only initiated within a specified timeframe during the day, ensuring that the strategy capitalises on the most liquid market hours to maximise the efficiency of entry and exit points.

- Market Strength or Breakouts: The system looks to enter trades during periods of market strength or when a breakout is detected. This is determined using machine learning algorithms that analyse 30-minute intraday data, identifying patterns that suggest an imminent rise in prices.

- Indicator Crosses: Entry decisions are also based on the crossing of certain technical indicators, which are mathematical calculations based on the price, volume, or open interest of a market. These indicators help to identify trends and turning points.

Exit Rules:

- Profit Targets and Stop Losses: The strategy uses predefined profit targets and stop losses to automatically close positions. A profit target is a predetermined point at which a trade will be closed to secure profits, while a stop loss is set to limit potential losses if the market moves against the position.

- Breakeven Stops: Once a trade has moved in favor by a certain amount, a breakeven stop can be activated. This adjusts the stop loss to the entry price, ensuring that if the market reverses, the trade will not result in a loss.

- Special Conditions Exit: The strategy includes provisions for exiting trades based on special conditions detected by its machine learning component. These could be indicators of a significant market reversal or other risk factors that warrant cutting losses early or taking profits sooner than planned.

- End of Day Exit: Trades are held for the day session only and will exit any open position at the close of the trading day.

Each of these rules contributes to a systematic approach designed to manage risk and capitalise on market opportunities efficiently. By adhering to these entry and exit parameters, the Bounce Strategy aims to maintain a balance between securing profits and limiting losses, based on the predictive power of machine learning and the strategic use of technical indicators.

6. How it Works in Practice

While the Bounce strategy provides strong setups for day trading in S&P 500 and Nasdaq futures, it's not infallible. Market conditions can sometimes be challenging, and rigorous risk management is essential. Traders should always be prepared for potential losses, underscoring the importance of having robust strategies for mitigating risk in unpredictable markets.

IDENTIFY OPPORTUNITY

Use the rules to find stocks that have hit a low point according to the strategy’s criteria.

ENTER THE TRADE:

Buy the stock when it meets the entry conditions.

SET PROFIT TARGET

Know in advance what the profit target is, based on the strategy’s profit target rule.

EXIT STRATEGY:

Sell the stock when it reaches the profit target or if any conditions suggest it’s time to exit to minimise losses.

OUTSOURCE YOUR TRADE EXECUTION

This strategy is fully mechanical which allows you to outsource the management of the strategy on your account to MyTradingAdvisor. MTA will monitor the system on a day to day basis and execute the orders for the system on your account according to the terms and condition in the Strategy Execution Document.

7. Risk Management

In the context of trading futures with the Bounce Strategy, risk management takes on a critical role due to the inherent leverage and volatility associated with futures contracts. The strategy employs several key mechanisms to manage risk and protect trading capital effectively.

The use of stop-loss orders is a fundamental risk management tool within the strategy. These orders are designed to limit potential losses by automatically closing out positions at predetermined price levels if the market moves against the trader’s position. This tool is invaluable for preserving capital by preventing large, uncontrolled losses.

Furthermore, the strategy employs profit targets and breakeven stops to secure gains and further mitigate risk. Profit targets allow traders to lock in earnings at specified levels, while breakeven stops adjust the stop-loss orders to the entry price once a trade has moved in the trader’s favor, protecting against the loss of accumulated profits if the market reverses.

Lastly, the Bounce Strategy leverages machine learning algorithms to analyse market data and identify optimal entry and exit points. This data-driven approach enhances the ability to enter and exit trades at the most opportune times, reducing the risk of entering or staying in unfavorable positions. By combining these risk management techniques, the Bounce Strategy aims to minimise losses, protect gains, and achieve a favorable risk-reward ratio for traders in the volatile futures market.

8. Strategy Statistics

Comprehensive Trading Performance Analysis Report

This section provides an in-depth analysis of our trading system’s performance, showcasing metrics like net profit, risk assessment, and efficiency. It details the outcomes of trading strategies involving the S&P 500 E-mini and Nasdaq 100 E-mini futures, emphasising profitability, drawdowns, and risk management. Through this report, traders can gain insights into the system’s effectiveness and make informed decisions.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce System Reports

- 1 Contract S&P 500 Emini version 1

- 1 Contract S&P 500 version 2

- 1 contract S&P 500 e-mini version 3

- 1 Contract Nasdaq 100 E-mini

- 1 Contract Russell E-mini

- 1 contract Dow e-mini

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10. For instance, the maximum drawdown will be $2,122 ($21,220/10).

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

Individual Market Performance Reports

The performance report above shows the portfolio performance for all 3 strategies. Below we show the system performance broken down into each individual market.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce Nasdaq E-mini System Report - Version 1

- 1 Contract S&P 500 Emini Bounce System

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce S&P E-mini System Report - version 2

- 1 Contract S&P 500 E-mini System version 2

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce S&P 500 E-mini System Report - version 3

- 1 Contract S&P500 E-mini

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce Russell 3000 E-mini System Report

- 1 Contract Russell 3000 E-mini version 1

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce Dow Jones E-mini System Report

- 1 Contract Dow Jones E-mini version 1

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

You can hover over each section to view drill down on performance, such as Annual, Monthly, Weekly, Equity Graphs etc.

Bounce Nasdaq 100 E-mini System Report

- 1 Contract Nasdaq 100 E-mini version 1

- Please note for traders with smaller capital you can trade Micro contracts.

- To calculate the Micro contract performance and capital requirements divide the numbers in the report below by 10 as micro contracts are 1/10 the size of E-mini contracts.

- Note Micro contracts are separate contracts, so historical performance will not be exactly the amount shown below divided by ten but should result in a relatively accurate approximation.

9. Examples

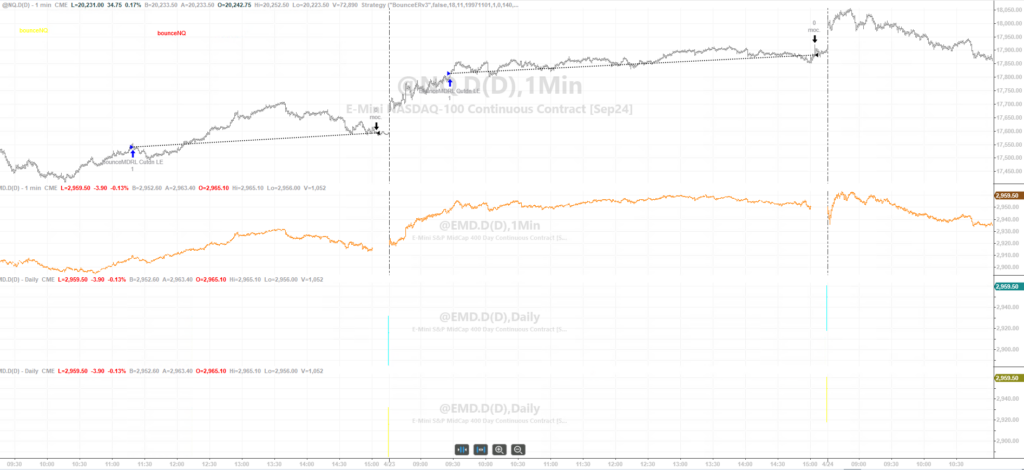

S&P E-Mini Contract Trade - Example 1

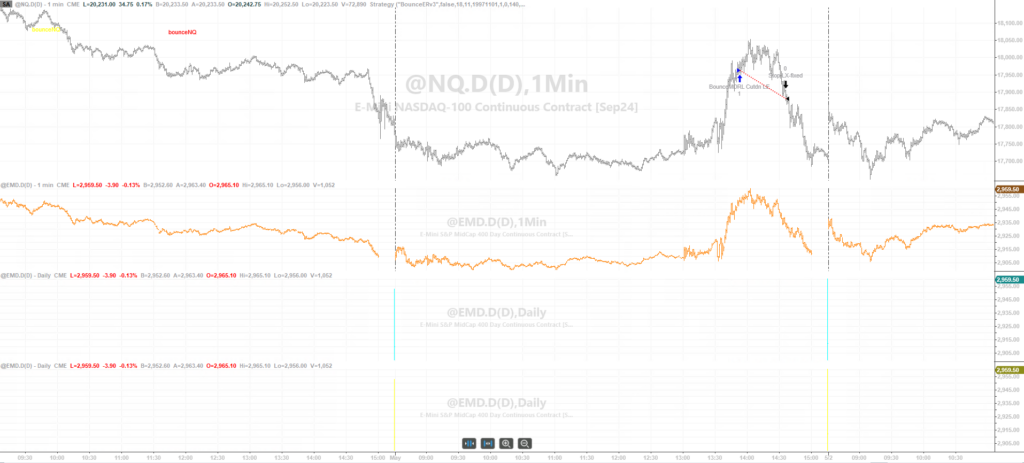

S&P E-Mini Contract Trade - Example 2

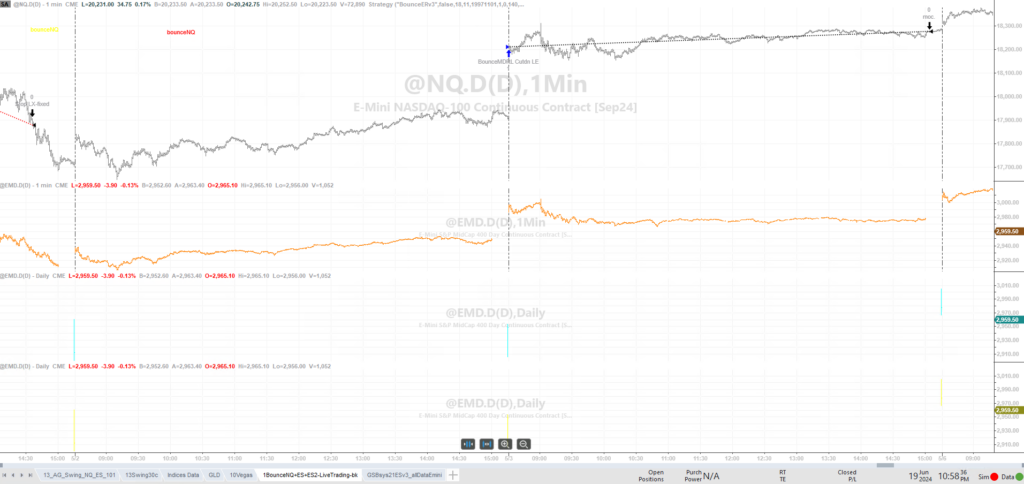

S&P E-Mini Contract Trade - Example 3

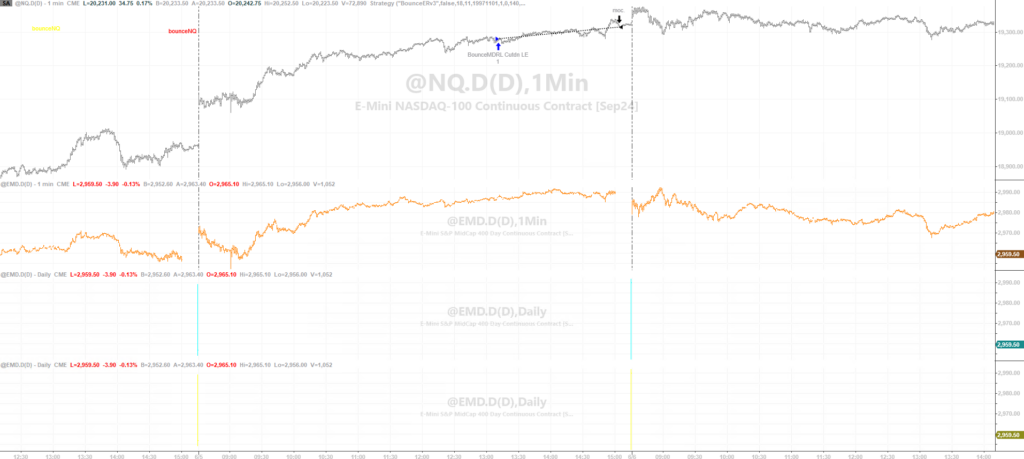

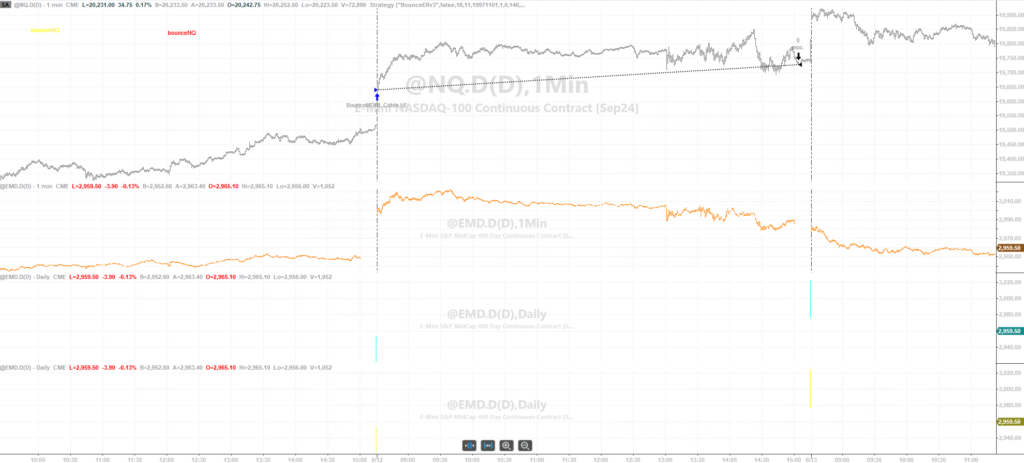

Nasdaq E-Mini Contract Trade - Example 4

Nasdaq E-Mini Contract Trade - Example 5

TO PROCEED CLICK "SIGN UP NOW"

The Bounce Strategy is a robust system, with the rules showing a strong historical positive expectancy. For traders seeking to amplify their investment portfolios this strategy is particularly enticing due to its strong performance metrics.

Investors interested in a disciplined and tested approach to trading, with clear historical evidence of success, should consider the Bounce Strategy as a compelling option for their short-term trading endeavours. It’s an opportunity to participate in a robust strategy that has the potential to demonstrate resilience and profitability over time.

To have this strategy executed for you on your trading account please select the ‘Sign Up Now” button below to proceed. On the next page you will be asked for your name, email and phone number. We will check to see if you have an existing account, if so we will send you our Strategy Execution Agreement. If not we will help you to open an account with Interactive Brokers, which will be linked to MTA so we are able to execute trade on your account once funded.