WEEKLY INCOME FROM TRADING THE ASX

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

S&P/ASX 200 Wheelhouse

Providing market based returns and comprehensive diversification, the Wheelhouse Strategy offers an exceptional opportunity to generate income from selling options on the ASX.

Our mission is to help our clients gain exposure to the stock market, without having to do any of the heavy lifting themselves. Best part – there are no joining fees and you can have the opportunity to have a professionally built strategy executed on your account.

1. Introducing S&P/ASX 200 Wheelhouse

The Wheelhouse Strategy lets you sell options on the ASX 200 Cash Index (AP) to earn weekly premiums of 0.5–1%. This cash-settled, European-style approach eliminates assignment risk and ensures a consistent, streamlined income, with guidance to manage options efficiently year-round.

The Wheelhouse Strategy is a robust approach to generating consistent weekly income through options trading on the ASX 200 Cash Index (AP). By leveraging European-style, cash-settled options, this strategy simplifies the trading process while offering steady premium income of approximately 0.5–1% weekly. It is designed for traders looking for a reliable cash flow, regardless of market conditions, and provides clear steps to manage trades efficiently.

This strategy focuses on precision and adaptability by selling delta 0.5 put options, balancing risk and reward. Whether options expire out-of-the-money (OTM) or in-the-money (ITM), the strategy ensures traders can maintain a systematic process to manage outcomes effectively. Unlike traditional options trading, there is no physical asset delivery, as all trades are cash-settled, eliminating assignment risk and simplifying execution.

The Wheelhouse Strategy is also designed to adapt dynamically to market conditions. Following an ITM settlement, it transitions to selling delta 0.75 puts to recover losses or capitalize on market rebounds, ensuring consistent performance. With step-by-step guidance from AIE, traders can confidently navigate market volatility and build a sustainable income stream throughout the year.

| S&P/ASX 200 Wheelhouse | Details |

|---|---|

| Minimum Investment | AU$20,000 |

| Market | AP (ASX 200 Index) |

| Strategy Type | Option Selling |

| Average Trade Length | 1 Week |

| Leverage | Optional |

| Suggested Portfolio Allocation | 20-30% |

2. What is the S&P/ASX 200 Index?

The ASX 200 Index options are derivative instruments tied to the S&P/ASX 200 Index, which represents the largest 200 companies on the Australian Securities Exchange. These options provide traders with a flexible way to hedge, speculate, or generate income based on the movement of the Australian stock market. With features like cash settlement, European-style exercise, and leverage, ASX 200 Index options are widely used by investors to gain exposure to the overall market without directly owning stocks.

KEY POINTS:

1

Underlying Asset:

Based on the S&P/ASX 200 Index, a benchmark of Australia’s largest companies.

2

European Style:

Options can only be exercised at expiration, simplifying management.

3

Cash Settled:

Settled in cash, with no physical delivery of shares required.

4

Contract Size:

Each contract is valued at $10 per index point, e.g., 7,000 index points = $70,000.

5

Use of Options:

Ideal for hedging portfolios, market speculation, or earning premium income.

6

Leverage:

Provides exposure to large market movements with a smaller initial margin.

3. Strategic Considerations

The Wheelhouse Strategy, focused solely on selling put options, adapts effectively to varying market conditions while maintaining a diversified approach to income generation. In an up market, selling delta 0.5 puts can generate consistent weekly premiums as the market steadily rises, reducing the likelihood of options expiring in the money. Traders benefit from a stable, predictable income stream, with the additional advantage of premiums declining less significantly in high-performing markets compared to outright ownership of assets, thus optimising returns.

In a sideways market, the strategy excels by capitalising on the time decay of options, which erodes their value as expiration approaches. Even when the underlying index fluctuates within a narrow range, put options are likely to expire out of the money, allowing traders to retain the full premium. This steady premium collection provides consistent income without requiring significant directional market movements, making it a robust approach in neutral or stagnant conditions.

During a down market, the strategy leverages the higher implied volatility that often accompanies market declines, resulting in increased option premiums. While the risk of in-the-money settlements rises, the elevated premiums provide a buffer against potential losses, enhancing income generation. The cash-settled nature of the options simplifies risk management, and the ability to transition to higher-delta puts ensures the strategy remains resilient. This approach allows traders to adapt dynamically, maintaining income potential even in challenging market environments.

4. How Does the Strategy Work?

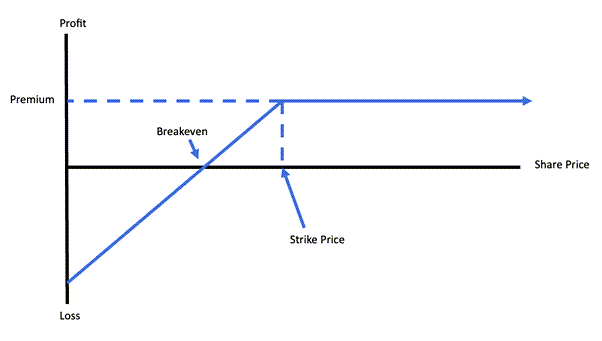

The Wheelhouse Strategy operates by selling put options on the ASX 200 Index, generating consistent weekly income through a disciplined and systematic approach. It begins by identifying options with a delta of approximately 0.5, which provides a balance between premium collected and the likelihood of expiring out of the money. These options typically have around a 50% chance of being exercised, making them ideal for optimising risk-reward while generating significant premiums.

Once the put options are sold, the focus shifts to managing their outcomes. If the options expire out of the money (OTM), the trader retains the entire premium, and the process repeats for the next weekly expiry. This cycle ensures a steady income stream in stable or rising markets, where the index remains above the strike price at expiry. The simplicity of this cash-settled, European-style options framework eliminates concerns about managing the physical underlying asset.

If the options expire in the money (ITM), the strategy transitions to a more aggressive recovery mode. In this case, the settlement is handled in cash, and the trader immediately sells higher-delta put options (around delta 0.75) for the next expiry. These options, being ITM at the time of sale, collect a significantly higher premium, which can help offset previous losses and benefit from potential market rebounds.

The higher-delta options provide a strategic response to market downturns, leveraging the increased premiums associated with higher implied volatility. In volatile conditions, the market compensates traders with elevated premiums, offering a cushion against losses while maintaining the income generation potential. This dynamic adjustment ensures the strategy remains resilient even during periods of heightened uncertainty.

As the higher-delta options expire, the strategy aims to revert to its original configuration. If the delta 0.75 puts expire worthless, the trader returns to selling delta 0.5 puts for subsequent expiries. This cyclical approach allows the strategy to continuously adapt to market conditions, balancing income generation with risk management.

Another key aspect of the strategy is its ability to benefit from time decay, or “theta,” which causes options to lose value as expiration approaches. This characteristic is particularly advantageous in sideways or stable markets, where the likelihood of options expiring worthless is higher. By consistently selling options close to expiration, the strategy captures maximum premium while minimising the time during which the market could move unfavourably.

Diversification across multiple contracts and expiry cycles further enhances the strategy’s effectiveness. By trading multiple options simultaneously, traders can smooth out the income stream and reduce the impact of any single position expiring ITM. This approach leverages the broad coverage of the ASX 200 Index to spread risk across a wide range of companies and sectors.

In summary, the Wheelhouse Strategy is a structured, adaptable approach to options trading that prioritises consistent income generation. Through systematic selling of delta 0.5 puts, dynamic adjustments with higher-delta options during downturns, and continuous management of outcomes, the strategy ensures robust performance across varied market conditions. Its focus on simplicity, resilience, and steady cash flow makes it an effective tool for traders seeking reliable returns.

5. Examples

Scenario 1: Bullish Market

In a bullish market, the Wheelhouse Strategy capitalises on rising prices by selling delta 0.5 puts on the ASX 200 Index (AP). Suppose the AP is trading at 7,000, and the trader sells a put option with a strike price of 7,000 for a premium of 40 points. With each point valued at $10, the premium collected equals $400 per contract. This premium represents immediate income, assuming the market remains above the strike price by expiry.

As the market trends upward, the AP closes at 7,050 on expiry day, comfortably above the 7,000 strike price. The option expires out of the money (OTM), allowing the trader to retain the entire premium collected. Since the option is cash-settled, no further action is required, and the trader simply repeats the process by selling another delta 0.5 put for the next weekly expiry. The consistent market rise ensures a high likelihood of options expiring worthless, maximising income potential.

If the trader identifies another opportunity in the following week, they may sell a put option with a strike price of 7,050, closer to the market’s new level. This adjustment aligns with the rising trend, allowing the trader to collect a similar premium of around 40 points. The key to the strategy’s success in bullish conditions lies in the steady premium income, which adds up week after week without significant risk of assignment or cash settlement.

The structured nature of the Wheelhouse Strategy ensures that even in a bullish market, the approach remains disciplined and systematic. By continuously selling delta 0.5 puts that match the prevailing market level, the trader optimises income while maintaining a manageable level of risk. This allows for a reliable cash flow that takes full advantage of the upward momentum in the ASX 200 Index.

Scenario 2: Sideways Market

In a sideways market, where the ASX 200 Index (AP) fluctuates within a narrow range, the Wheelhouse Strategy thrives by capturing consistent premium income through time decay. For example, if the AP is trading around 7,000 and the trader sells a delta 0.5 put option with a strike price of 7,000 for a premium of 40 points ($400 per contract), the strategy capitalises on the likelihood that the index will remain near this level. As expiration approaches, the option’s value decreases due to time decay, benefiting the trader as the premium erodes.

Suppose the AP moves slightly within the range of 6,980 to 7,020 throughout the week but ultimately closes at 7,010, just above the strike price. The sold option expires out of the money (OTM), and the trader retains the full $400 premium without any additional risk. The predictable range-bound market conditions make sideways markets ideal for consistently collecting premiums, as the limited price movement reduces the chance of significant losses while allowing time decay to work in the trader’s favour. The trader can then repeat the process for the next expiry, maintaining a steady income stream.

Scenario 3: Bearish Market

In a down market, the Wheelhouse Strategy adjusts to take advantage of increased implied volatility (IV) that accompanies declining prices, which raises the premiums for options. Suppose the ASX 200 Index (AP) is trading at 7,000, and the trader sells a delta 0.5 put with a strike price of 7,000 for a premium of 50 points ($500 per contract), higher than in less volatile conditions. As the market declines to 6,950 by expiry, the option finishes in the money (ITM), triggering a cash settlement of 50 points ($500 loss). However, the premium collected offsets this loss, resulting in a net-zero outcome for the trade.

After the ITM settlement, the strategy shifts to selling higher-delta put options, such as delta 0.75 puts, to recover from the downward movement. For instance, the trader might sell a 6,900 strike put for a premium of 100 points ($1,000 per contract), which is significantly higher due to the elevated IV and the ITM nature of the option. If the market stabilises or rebounds slightly, the trader retains the higher premium, recouping earlier losses and benefitting from the robust premiums generated in volatile conditions.

The ability to adapt dynamically ensures that the strategy remains effective in down markets. As the trader continues selling higher-delta puts until the market stabilises, they eventually revert to delta 0.5 puts when premiums return to normal levels. By leveraging the increased premiums from heightened volatility and using a disciplined approach to manage ITM settlements, the strategy minimises losses while maintaining consistent income. This makes it a resilient option for navigating bearish conditions while preparing for market recovery.

The Wheelhouse Strategy is a disciplined trading approach designed to generate consistent weekly income by selling put options on the ASX 200 Index (AP). Focused on cash-settled, European-style options, the strategy adapts to market conditions to ensure steady performance. By selling delta 0.5 puts in stable markets and higher-delta puts during downturns, traders can maximise premiums while managing risk effectively.

This strategy excels across all market scenarios, leveraging increased premiums in volatile conditions and capturing steady income in stable or rising markets. Its structured yet flexible design makes it an ideal choice for traders seeking reliable returns and simplified execution.

Take control of your trading today! Sign up now to start earning consistent weekly income with the Wheelhouse Strategy. With expert guidance and a proven approach, you’ll have everything you need to succeed. Join now and build your financial future!