BITCOIN ALHPA YIELD

Discover how you can make regular and consistent weekly income from Bitcoin , whilst being totally hands off with your trading account.

REGULAR AND CONSISTENT WEEKLY INCOME

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Bitcoin Alpha Yield

Designed for hands-off execution, this strategy focuses on systematic and disciplined options selling, supervised entirely by My Trading Advisor (MTA).

We aim to help clients gain exposure to the cryptocurrency market while minimising the complexities and workload typically associated with trading. Best of all, for a limited time we are waiving the joining fees, and you’ll have a professionally developed strategy executed directly in your trading account.

1. Introducing Bitcoin Alpha Yield

With the Bitcoin Alpha Yield Strategy, you can generate weekly income by leveraging options trading on the iShares Bitcoin Trust (IBIT). Designed for hands-off execution, this strategy focuses on systematic and disciplined options selling, supervised entirely by My Trading Advisor (MTA).

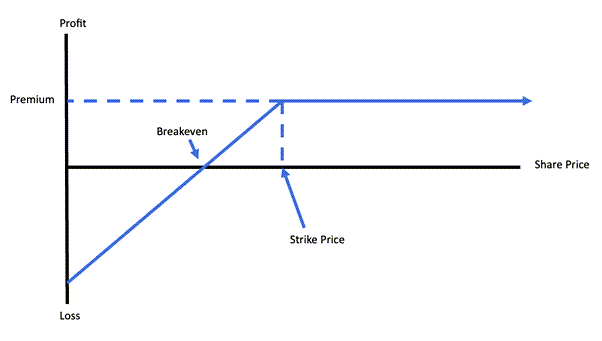

The Bitcoin Alpha Yield Strategy generates consistent income by selling options on the iShares Bitcoin Trust (IBIT), leveraging Bitcoin’s price movements while managing its volatility. By selling delta 0.5 puts with short expiries, traders earn steady weekly premiums, resetting the process if options expire out of the money (OTM).

If options expire in the money (ITM), the strategy involves acquiring IBIT shares and selling delta 0.3 covered calls to generate additional income while managing downside risk. This dynamic approach takes advantage of higher premiums during volatile markets, ensuring options profitability even in uncertain conditions.

With disciplined execution and a focus on steady cash flow, the Bitcoin Alpha Yield Strategy provides a structured way to gain exposure to Bitcoin while mitigating some of the risks. It offers a reliable income stream from one of the most volatile yet rewarding asset classes.

| Bitcoin Alpha Yield | Details |

|---|---|

| Minimum Investment | US$7,000 (IBIT price x 100) |

| Market | IBIT |

| Strategy Type | Option Selling |

| Average Trade Length | 1 Week |

| Leverage | Optional |

| Suggested Portfolio Allocation | 10%+ |

2. What is the IBIT ETF?

The iShares Bitcoin Trust (IBIT) is a financial product that tracks the performance of Bitcoin, offering exposure to Bitcoin without the need to own it directly. Unlike cash-settled options, IBIT options are share-settled, requiring careful management of any assigned shares.

KEY POINTS:

1

Tracks the price of Bitcoin:

Gain indirect exposure to Bitcoin’s price movements without owning cryptocurrency.

2

Weekly Income Potential:

Earn consistent premiums from selling options.

3

Hands Free Execution

Managed entirely by MTA, so you don’t need to monitor positions daily.

4

Investment Strategy:

Ideal for investors with high-risk tolerance looking to maximise potential returns in a volatile market.

5

Use of Options:

Offers an opportunity for investors with small to medium-sized accounts to leverage options for enhanced returns.

6

Risk Management:

Dynamic strategy helps balance potential risks and returns.

3. Strategic Considerations

The "Bitcoin Alpha Yield" strategy, introduced by My Trading Advisor (MTA), offers a sophisticated approach to options trading, specifically designed to harness the volatility and liquidity of the iShares Bitcoin Trust (IBIT). This Bitcoin-linked ETF is the foundation of the strategy, providing a dynamic environment for options traders due to its significant price movements and potential for substantial premiums. At the core of the strategy is the selling of put options, enabling traders to generate a consistent weekly premium, typically ranging from 1-3% or more. This approach leverages the extrinsic value of options, which is shaped by the underlying asset's volatility and expiry period, offering a powerful mechanism to create steady income from the natural fluctuations of the market.

However, it’s important to recognise that higher potential returns come with increased risk, particularly given the inherent volatility of an asset like the iShares Bitcoin Trust (IBIT). The Bitcoin Alpha Yield strategy is designed for the higher-risk segment of an investor’s portfolio, placing strong emphasis on effective risk management and strategic adjustments in response to market conditions. Whether the market moves up, down, or sideways, the strategy advocates for flexibility in selecting strike prices for put selling—whether out-of-the-money, at-the-money, or in-the-money—underscoring the dynamic nature of market fluctuations and the necessity for ongoing adaptation.

In the event of a market downturn resulting in asset assignment, the Bitcoin Alpha Yield strategy recommends transitioning to selling out-of-the-money calls. This approach helps to mitigate losses while strategically recovering value through carefully selected strike prices, thereby maximising income and reducing the impact of market declines. By adopting this disciplined and patient methodology, traders aim to recover lost intrinsic value during downturns and benefit from eventual market rebounds. This framework highlights the potential for achieving higher long-term returns by effectively managing risk and capitalising on Bitcoin’s inherent volatility, making it an attractive strategy for investors prepared to navigate higher risks for greater rewards.

4. How Does the Strategy Work?

The Bitcoin Alpha Yield Strategy is a structured approach to generating consistent weekly income by selling options on the iShares Bitcoin Trust (IBIT). It begins with selling delta 0.5 put options, typically with short expiries of 2-7 days. These puts offer a balance between premium collection and risk, with about a 50% chance of expiring in the money (ITM). The short time frame ensures traders capture the maximum time decay, or “theta,” which accelerates as expiration approaches.

If the put options expire out of the money (OTM), meaning the IBIT price remains above the strike price, the trader keeps the entire premium collected. This process is then repeated for the next expiry, maintaining a consistent cycle of income generation. In stable or slightly bullish market conditions, this approach works particularly well, as the likelihood of OTM expiration increases, providing steady returns with reduced risk.

In cases where the put options expire in the money (ITM), the strategy shifts focus. When IBIT closes below the strike price, the trader is obligated to purchase the underlying IBIT shares at the agreed strike price. While this may initially seem like a loss, the premium collected offsets some of the cost, and the trader gains ownership of the underlying asset, providing new opportunities for income generation.

Once IBIT shares are acquired, the strategy transitions to selling delta 0.3 covered calls against the shares. These calls provide additional income while limiting risk. For example, if IBIT rebounds or remains stable, the call premium further enhances overall returns. If the call expires OTM, the trader retains both the shares and the premium, allowing them to continue selling additional covered calls.

When the covered call expires in the money, the shares are called away at the strike price, locking in a sale price that includes the call premium. This outcome effectively closes the trade with a potential profit, as the premium and strike price together often exceeds the initial cost basis of the shares. The trader then reverts to selling delta 0.5 puts, resuming the original cycle of the strategy.

The strategy thrives during volatile markets because higher implied volatility (IV) increases option premiums. Elevated IV during market uncertainty provides traders with more income potential, creating a cushion against adverse price movements. This makes the strategy particularly effective in navigating Bitcoin’s inherent volatility while maintaining more consistent returns than holding Bitcoin itself.

The short expiry of the options sold is another critical aspect of the strategy. By trading options with just a few days to expiry, the strategy maximises time decay, ensuring premiums are collected quickly. This short time horizon also limits the exposure to significant price swings, as there is less time for the market to move drastically against the position.

Dynamic adjustments are built into the strategy to ensure flexibility and resilience. By switching from delta 0.5 puts to delta 0.3 calls when options expire ITM, traders can adapt to changing market conditions while maintaining income generation. This adaptability allows the strategy to perform effectively across a range of scenarios, from bullish trends to sharp price corrections.

In summary, the Bitcoin Alpha Yield Strategy is a systematic and adaptable method to generate weekly income by selling options on IBIT. By capitalising on time decay, implied volatility, and dynamic position management, the strategy ensures consistent cash flow while managing risks associated with Bitcoin’s price movements. It offers traders a disciplined approach to one of the most volatile asset classes, delivering a balance of income and risk mitigation.

5. Examples

The strategy consists of several rules for deciding when to buy (enter) or sell (exit) stocks. These rules are based on technical indicators, primarily focusing on the Average True Range indicator (ATR) and the Relative Strength Indicator (RSI).

Scenario 1: Bullish Market

- In a bullish market, where IBIT is trading at $59.62 and expected to rise, the Bitcoin Alpha Yield Strategy focuses on selling delta 0.5 put options. For instance, the trader sells a put option with a strike price of $60 expiring in one week, collecting a premium of $2 per share. This premium provides immediate income while taking advantage of Bitcoin’s upward momentum.

- If IBIT closes above $60 at expiration, the option expires out of the money (OTM), and the trader retains the entire $2 premium without any obligation. This outcome is typical in a bullish market as the underlying asset rises above the strike price. The process is then repeated, with the trader selling new delta 0.5 puts for the next expiry.

- By continuously selling puts near the prevailing IBIT price, the trader maximises returns while maintaining a disciplined and consistent income-generating cycle. The bullish trend reduces the likelihood of options finishing in the money (ITM), making this strategy particularly effective during rising markets.

- This approach allows the trader to earn reliable weekly premiums, aligning with Bitcoin’s positive price movement. By focusing on short-term expiries, the strategy minimises risk exposure while maximising returns during bullish conditions.

Scenario 2: Sideways Market

- In a sideways market, where IBIT fluctuates around $59.62, the strategy benefits from time decay (theta). The trader sells a delta 0.5 put with a strike price of $59 expiring in one week, collecting a premium of $1.50 per share. The proximity of the strike price to the current price ensures a balance between income and risk.

- If IBIT closes slightly above $59 at expiration, the option expires out of the money (OTM), allowing the trader to retain the entire premium. Even if IBIT closes slightly below the strike price, the loss is limited, as the premium received offsets the difference between the strike price and the settlement price.

- The consistent collection of premiums ensures a steady income stream even in the absence of significant price movement. By repeating this process weekly, the trader capitalises on the stagnant price environment while maintaining control over risk exposure.

- This strategy thrives in stable markets, where the likelihood of drastic price movements is low, allowing the trader to leverage time decay for consistent returns. The short expiry periods ensure quick premium collection and minimal market exposure.

Scenario 3: Bearish Market

In a bearish market, where IBIT declines from $59.62, the strategy adjusts to leverage increased implied volatility (IV), which raises option premiums. The trader sells a delta 0.5 put with a strike price of $58 expiring in one week, collecting a premium of $3 per share. The elevated premium provides a cushion against potential losses from further declines.

If IBIT closes below $58 at expiration, the option finishes in the money (ITM), and the trader purchases the shares at $58. The $3 premium reduces the effective purchase price to $55, softening the impact of the price drop. The trader now owns IBIT shares at a discount relative to the original strike price.

Following the ITM settlement, the strategy transitions to selling delta 0.3 covered calls on the acquired IBIT shares to generate additional income. For example, a call option with a $59 strike price might yield $1.50 per share in premium. If the shares are called away, the effective sale price, including premiums, exceeds the purchase price, resulting in a net profit.

This dynamic adjustment ensures the strategy remains resilient in bearish conditions, turning volatility into an advantage. By continuously adapting, the trader mitigates losses, generates income, and positions for eventual market recovery.

The Bitcoin Alpha Yield Strategy is a reliable, supervised approach to generating consistent weekly income by trading options on the iShares Bitcoin Trust (IBIT). By selling delta 0.5 put options, the strategy captures steady premiums while managing risk effectively. Its structured process adapts seamlessly to rising, stable, or volatile market conditions, offering traders a disciplined way to earn income.

What makes this strategy unique is its ability to adjust to market changes. During volatile periods, higher implied volatility (IV) increases option premiums, providing greater income potential and offsetting risks. The strategy dynamically transitions to covered calls or higher-delta puts when needed, ensuring resilience and profitability across all scenarios.

Take the next step toward consistent income with the Bitcoin Alpha Yield Strategy. With expert guidance, you’ll gain the confidence to trade effectively and maximise returns. Sign up now to start building your financial future!