PRIVATE WEALTH LITE

Enjoy reliable returns without the need for active management or constant oversight.

STEADY AND RELIABLE WEEKLY INCOME

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Private Wealth Lite

Offering consistent returns and total diversification, this is your opportunity to have MTA execute the Private Wealth Lite strategy for you.

Our mission with Private Wealth Lite is to provide clients with seamless access to the stock market without the need for hands-on management. Best of all, there are no joining fees, and you can benefit from having a professionally designed strategy executed directly on your account.

1. Introducing Private Wealth Lite

With this strategy, you can sell options on exchange traded funds (ETFs) and receive a weekly premium in the order of around 1-3% plus. We'll guide you through the concept of options selling and show you how to consistently receive a weekly premium, pretty much all year round.

The Private Wealth Lite strategy focuses on selling put options and, if assigned, transitioning to owning shares while selling call options, a process commonly known as a Covered Call. This approach can be applied to a variety of stocks or ETFs, but this guide highlights its application to diversified ETFs like XSP, IBIT, and GLD. These assets are selected for their liquidity, volatility, and suitability for generating consistent income.

Selling put options is generally less volatile and offers a degree of downside protection compared to outright ownership of the underlying asset. The strategy capitalises on extrinsic value, or time value, which depends on factors like strike price, expiry, and volatility. For example, weekly at-the-money puts with moderate volatility often yield premiums in the range of 1% to 3% of the underlying asset’s price, providing a steady source of income.

Assuming an average 1% weekly income, this strategy can generate substantial returns even if the market remains flat over a year. While potential losses from market declines must be factored in, the income from options premiums acts as a buffer, helping to offset those losses and support portfolio stability.

If you’re ready to discover the potential of the Private Wealth Lite strategy and start earning consistent weekly income, explore the information below and take the first step toward your financial goals.

| Private Wealth Lite | Details |

|---|---|

| Minimum Investment | AUD$150,000 |

| Market | XSP, GLD, IBIT |

| Strategy Type | Option Selling |

| Average Trade Length | 1 Week |

| Leverage | Optional |

| Suggested Portfolio Allocation | Up to 100% |

2. What is Private Wealth Lite?

The Private Wealth Lite strategy generates consistent weekly income by trading options on a diversified portfolio of ETFs, including XSP (equities), GLD (gold), and IBIT (Bitcoin). It involves selling put options to earn premiums and, if assigned, transitioning to covered calls to enhance income. This structured approach balances risk and reward, leveraging the unique dynamics of each ETF to provide steady returns across various market conditions. Designed for simplicity and reliability, it offers investors a hands-off way to achieve portfolio diversification and consistent income.

KEY POINTS:

1

Diversified Portfolio:

Trades options on XSP (equities), GLD (gold), and IBIT (Bitcoin) for balanced exposure and reduced risk.

2

Weekly Income Generation:

Earns consistent weekly premiums by selling put options on carefully selected ETFs.

3

Risk Management:

Combines equity growth, gold stability, and Bitcoin’s high potential to manage overall portfolio risk effectively.

4

Adaptability:

Transitions to covered calls when assigned, ensuring continued income in various market conditions.

5

Hands Off Approach

Designed for investors who prefer a professionally executed strategy without active involvement.

6

Reliable Returns

Provides a structured, consistent income stream tailored to meet diverse investment objectives.

3. Strategic Considerations

The Private Wealth Lite strategy is built around thoughtful diversification and strategic risk management to maximise income and minimise exposure to market volatility. By trading options on XSP, GLD, and IBIT, the strategy leverages the unique characteristics of these ETFs to create a balanced portfolio. XSP offers exposure to U.S. large-cap equities, GLD provides stability as a safe-haven asset, and IBIT delivers high-growth potential with Bitcoin. This combination ensures a natural hedge against market fluctuations, as the assets often behave differently under varying economic conditions.

A key strategic consideration is the disciplined approach to selling put options. The strategy focuses on delta 0.5 puts, balancing the likelihood of options expiring out of the money with the potential for earning substantial premiums. If assigned, the transition to selling covered calls provides an additional layer of income, allowing investors to benefit from both time decay and market recovery. This dual-income mechanism ensures that the strategy remains profitable even in less favourable conditions, such as market corrections or increased volatility.

To ensure long-term success, the strategy emphasises careful position sizing and risk mitigation. Each trade is designed to align with the broader portfolio objectives, maintaining exposure across different asset classes while avoiding over-concentration in any single area. The inclusion of GLD and IBIT alongside XSP adds resilience, with gold acting as a hedge against equity downturns and Bitcoin contributing potential for outsized returns. By combining these elements, Private Wealth Lite delivers a consistent, reliable approach to generating weekly income in diverse market environments.

4. How Does the Strategy Work?

The Private Wealth Lite strategy focuses on generating consistent weekly income by trading options on a diversified portfolio of ETFs, including XSP (S&P 500 Mini Index), GLD (Gold ETF), and IBIT (Bitcoin ETF). It begins with selling delta 0.5 put options, typically with short expiries of 2-7 days. This approach captures premium income while balancing the risk of the options finishing in the money (ITM) and provides exposure to diverse asset classes for reduced portfolio risk.

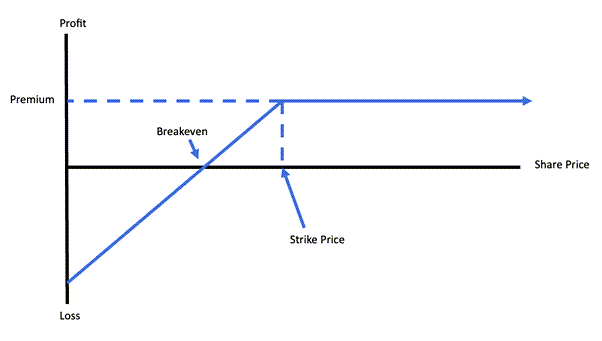

When put options expire out of the money (OTM), meaning the underlying ETF closes above the strike price, the trader keeps the full premium without any obligation to purchase the ETF. This outcome is common in stable or rising markets, ensuring a steady income stream. The process is then repeated weekly, generating consistent returns by leveraging time decay and market stability.

If the put options expire ITM, the strategy transitions to acquiring the underlying ETF shares at the strike price. This allows the trader to benefit from owning the asset, often at a discount due to the premium collected. For example, if GLD closes below the strike price, the trader takes ownership of GLD shares and moves to the next phase of the strategy.

The next step involves selling covered calls on the acquired shares, typically with a delta of 0.3, to generate additional income. Covered calls allow the trader to earn premiums while setting a potential exit price for the shares. This approach adds a layer of income even in volatile or down markets, leveraging the shares to enhance returns.

If the covered call expires OTM, the trader retains the shares and the premium, continuing to sell further covered calls for subsequent expiries. This process ensures the asset remains productive, generating income even if the underlying price remains flat or marginally volatile. If the call expires ITM, the shares are sold at the strike price, locking in a profit that includes the premium collected.

The strategy’s adaptability to various market conditions ensures consistent performance. In a stable market, put options regularly expire OTM, providing reliable weekly income. In a down market, higher implied volatility (IV) increases option premiums, which enhances income potential while mitigating the impact of price declines. These elevated premiums act as a natural buffer against losses.

Time decay, or theta, plays a critical role in the strategy’s success. Short-dated options lose value quickly as they approach expiration, allowing the trader to capture the maximum premium within a short period. This rapid time decay minimises risk exposure while maximising returns, especially in sideways markets where price movement is minimal.

Diversification across XSP, GLD, and IBIT strengthens the strategy further. XSP provides equity exposure, GLD offers stability as a safe-haven asset, and IBIT delivers high-growth potential. This combination balances the portfolio, ensuring that no single market event disproportionately affects performance, while each ETF contributes unique strengths.

In summary, the Private Wealth Lite strategy works by combining put selling and covered calls on a diversified set of ETFs. Its disciplined, systematic approach ensures consistent income across varying market conditions, leveraging time decay, volatility, and diversification to deliver reliable returns. This method provides investors with a hands-off way to generate weekly income while managing risk effectively.

5. Examples

The strategy consists of several rules for deciding when to buy (enter) or sell (exit) stocks. These rules are based on technical indicators, primarily focusing on the Average True Range indicator (ATR) and the Relative Strength Indicator (RSI).

Scenario 1: Bullish Market

- In a bullish market, where XSP, GLD, and IBIT are experiencing upward trends, the Private Wealth Lite strategy capitalises on this momentum by selling delta 0.5 put options near the current market prices. For instance, with XSP trading at $599.67, the trader might sell a put option with a $600 strike price, collecting a premium of approximately $4.50 per share. Similarly, with GLD at $249.27, a $250 strike price put could yield a $3.00 premium, and for IBIT at $59.62, a $60 strike price put might garner a $2.00 premium.

- At expiration, if these ETFs close above their respective strike prices, the put options expire worthless, allowing the trader to retain the full premiums. This outcome is typical in a bullish market, where the underlying assets appreciate or remain stable above the strike prices. The trader then repeats the process, selling new delta 0.5 puts for the following expiry, ensuring consistent weekly income.

- This cycle of selling puts in a bullish market provides reliable returns with minimal risk, as the chances of assignment remain low. Additionally, the trader can benefit from slightly higher premiums in bullish conditions due to moderate implied volatility. This consistency makes the strategy particularly effective during prolonged market uptrends.

- By focusing on short-term options and resetting positions weekly, the strategy ensures traders can lock in frequent gains while limiting exposure to sudden market reversals. This systematic approach provides a dependable income stream while benefiting from the overall upward trend in the ETFs.

Scenario 2: Sideways Market

- In a sideways market, where XSP, GLD, and IBIT prices fluctuate within narrow ranges, the strategy leverages time decay (theta) to generate income. For example, with XSP at $599.67, selling a $600 strike price put option might yield a $3.00 premium. Similarly, with GLD at $249.27, a $250 strike price put could provide a $2.50 premium, and for IBIT at $59.62, a $60 strike price put might offer a $1.50 premium.

- At expiration, if these ETFs close near or above their respective strike prices, the put options expire worthless, allowing the trader to retain the full premiums. Even if the ETFs close slightly below the strike prices, the premiums collected help offset the differences, minimising net losses or even resulting in break-even outcomes.

- The process is repeated weekly, with the trader continuing to sell puts on these stable assets. The consistent erosion of option value due to time decay ensures regular income, even when the market lacks clear direction. This makes the strategy particularly suited for markets that are consolidating or trading in tight ranges.

- By leveraging short-term options, the trader can take advantage of frequent expirations to reset positions and capture new premiums. This structured approach ensures income generation remains steady, even in conditions where price movements are minimal or lack strong trends.

Scenario 3: Bearish Market

- In a bearish market, where XSP, GLD, and IBIT are declining, the Private Wealth Lite strategy adapts by selling delta 0.5 put options at strike prices slightly below the current market prices to collect higher premiums due to increased implied volatility. For instance, with XSP at $599.67, selling a $595 strike price put might yield a $5.00 premium. Similarly, with GLD at $249.27, a $245 strike price put could provide a $4.00 premium, and for IBIT at $59.62, a $58 strike price put might offer a $2.50 premium.

- If these ETFs close below their respective strike prices at expiration, the options finish in the money (ITM), and the trader purchases the shares at the strike prices. The premiums collected reduce the effective purchase prices, providing a cushion against the declining market. The trader then transitions to selling delta 0.3 covered calls on the acquired shares to generate additional income.

- For example, after acquiring XSP at an effective price of $590 (strike price minus premium), the trader could sell a covered call with a $600 strike price, collecting another $3.00 per share in premium. If XSP stabilises or rebounds slightly, the shares might be called away at $600, locking in a sale price above the effective purchase price. This ensures the trader generates income even in challenging market conditions.

- By dynamically adjusting to market movements and using higher premiums to offset risks, the strategy remains resilient. The ability to transition between puts and covered calls ensures income generation continues, even during sustained downtrends, while providing opportunities to recover losses as markets stabilise.

The Private Wealth Lite Strategy is a systematic approach to generating consistent weekly income by trading options on a diversified portfolio of ETFs, including XSP (S&P 500 Mini Index), GLD (Gold ETF), and IBIT (Bitcoin ETF). This strategy combines the stability of equities, the safe-haven qualities of gold, and the high-growth potential of Bitcoin to create a balanced and resilient income-generating portfolio. By selling put options and transitioning to covered calls if assigned, the strategy provides steady returns while managing risk effectively.

What sets Private Wealth Lite apart is its adaptability across varying market conditions. Whether the market is bullish, sideways, or bearish, the strategy dynamically adjusts to ensure income generation continues. Selling delta 0.5 puts captures time decay and elevated premiums, while the inclusion of gold and Bitcoin provides natural diversification to hedge against market volatility. This structured, hands-off approach allows investors to enjoy consistent cash flow without the need for active portfolio management.

Take control of your financial future with the Private Wealth Lite Strategy. With expert guidance and a proven method, you can start earning reliable weekly income while maintaining a diversified and professionally executed portfolio. Sign up today and discover how Private Wealth Lite can simplify your trading journey and deliver consistent results!