PRIVATE WEALTH PLATINUM

Enjoy dependable weekly returns without requiring active management or constant oversight of your trading account.

CONSISTENT & DEPENDABLE OPTIONS INCOME

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Private Wealth Platinum

Offering consistent returns and total diversification, this is your opportunity to have MTA execute the Private Wealth Lite strategy for you.

PlatinumOur mission with Private Wealth Lite is to provide clients with seamless access to the stock market without the need for hands-on management. Best of all, there are no joining fees, and you can benefit from having a professionally designed strategy executed directly on your account.

1. Introducing Private Wealth Platinum

Unlock the power of consistent weekly income with Private Wealth Platinum. Trade options on a diversified portfolio of ETFs, including equities, gold, and Bitcoin, to generate steady returns. Let us guide you through a proven strategy designed for success all year round!

Private Wealth Platinum is a premium options trading strategy designed to deliver consistent weekly income by trading options on a diversified portfolio of exchange-traded funds (ETFs). This strategy includes SPY (S&P 500 ETF), QQQ (Nasdaq 100 ETF), IWM (Russell 2000 ETF), GLD (Gold ETF), and IBIT (Bitcoin ETF), providing balanced exposure to equities, gold, and cryptocurrency. By strategically selling options, the strategy ensures steady returns while maintaining disciplined risk management.

A key strength of this strategy is its diversification. SPY, QQQ, and IWM offer exposure to different segments of the U.S. equity market, while GLD provides a defensive hedge, and IBIT adds the potential for high growth through Bitcoin. This mix creates a portfolio designed to perform across various market conditions, balancing income generation with resilience against volatility.

The core of Private Wealth Platinum is selling options to collect weekly premiums. The strategy adapts to market conditions, using short-term options to capture consistent income while minimising long-term risk. With a disciplined and adaptable approach, it ensures reliable returns regardless of whether the market is rising, falling, or moving sideways.

Private Wealth Platinum is ideal for investors looking for a hands-off, professionally executed strategy to achieve consistent income. Whether you’re experienced in options trading or just getting started, this strategy offers a streamlined way to diversify your portfolio and generate reliable, ongoing returns.

| Private Wealth Lite | Details |

|---|---|

| Minimum Investment | AUD$500,000 |

| Market | QQQ, SPY, IWM, GLD, IBIT |

| Strategy Type | Option Selling |

| Average Trade Length | 1 Week |

| Leverage | Optional |

| Suggested Portfolio Allocation | Up to 100% |

2. What is Private Wealth Platinum?

Private Wealth Platinum is a premium options trading strategy designed to generate consistent weekly income through a diversified portfolio of ETFs, including SPY, QQQ, IWM, GLD, and IBIT. By selling options strategically, the strategy leverages the growth potential of equities, the stability of gold, and the high returns of Bitcoin. With a disciplined and adaptable approach, Private Wealth Platinum provides reliable income while managing risk, making it an ideal solution for investors seeking a hands-off, professionally managed way to achieve steady returns.

KEY POINTS:

1

Diversified Portfolio:

Trades options on SPY, QQQ, IWM, GLD, and IBIT to provide balanced exposure to equities, gold, and Bitcoin.

2

CONSISTENT WEEKLY INCOME

Generates reliable weekly premiums by strategically selling options across a range of ETFs.

3

Risk Management:

Combines high-growth assets like Bitcoin with defensive assets like gold to mitigate volatility and manage risk effectively.

4

Adaptability:

Adjusts dynamically to bullish, bearish, and sideways markets, ensuring steady performance in any environment.

5

Hands Off Approach

Professionally executed strategy allows investors to focus on consistent returns without the need for active involvement.

6

Proven Methodology

Built on a structured, disciplined approach to options trading, ensuring reliable income generation year-round.

3. Strategic Considerations

The Private Wealth Platinum strategy is carefully designed to maximise income while managing risk through diversification and strategic options trading. By including SPY, QQQ, IWM, GLD, and IBIT in its portfolio, the strategy benefits from exposure to multiple market sectors and asset classes. SPY and QQQ provide access to large-cap and tech-focused equities, IWM captures small-cap growth, GLD offers stability as a safe-haven asset, and IBIT brings high-return potential through Bitcoin. This diverse mix ensures the portfolio can adapt to changing market conditions while reducing the impact of individual asset volatility.

A key strategic consideration is the disciplined approach to selling options. The strategy focuses on delta 0.5 puts to balance premium collection with manageable risk. In bullish markets, this approach generates steady income as options typically expire out of the money. During sideways markets, the strategy capitalises on time decay, ensuring consistent returns even without significant price movements. In bearish conditions, elevated implied volatility increases premiums, providing a cushion against potential losses. By dynamically adjusting to market trends, the strategy maintains resilience and profitability.

Risk management is central to Private Wealth Platinum’s success. The inclusion of defensive assets like GLD offsets potential losses in equities, while IBIT adds growth opportunities that can boost returns in volatile markets. Position sizing and short-term expiries further minimise exposure to adverse market shifts, enabling consistent performance over time. This strategic framework ensures that the portfolio remains well-balanced, making Private Wealth Platinum an effective, hands-off solution for generating reliable income while navigating diverse market environments.

4. How Does the Strategy Work?

The Private Wealth Platinum strategy is designed to generate consistent weekly income by trading options on a diversified portfolio of ETFs, including SPY (S&P 500 ETF), QQQ (Nasdaq 100 ETF), IWM (Russell 2000 ETF), GLD (Gold ETF), and IBIT (Bitcoin ETF). It focuses on selling delta 0.5 put options with short-term expiries, typically one week, to maximise premium income while balancing risk. By leveraging the unique characteristics of each ETF, the strategy ensures consistent returns and portfolio stability across various market conditions.

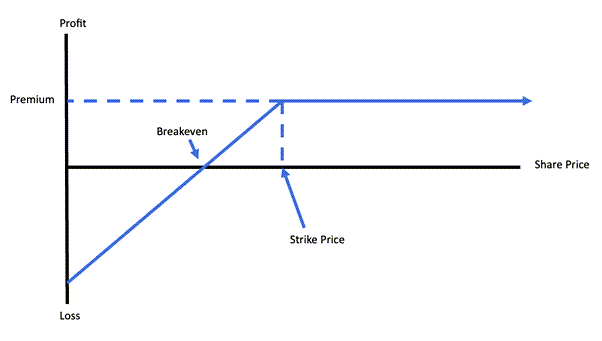

When selling delta 0.5 put options, the strategy captures premiums by targeting a balance between the likelihood of the options expiring out of the money (OTM) and the income generated. For instance, if SPY is trading at $450, a $450 strike price put may yield a $4.50 premium. If the ETF remains above the strike price at expiration, the option expires OTM, and the premium is retained without any obligation to purchase the ETF. This process is repeated weekly for all selected ETFs.

If an option expires in the money (ITM), such as SPY closing below $450, the trader acquires the shares at the strike price. The premium collected reduces the effective purchase price, cushioning the impact of a falling market. For example, if SPY closes at $445, the effective purchase price would be $445.50, considering the $4.50 premium. This approach ensures that even ITM scenarios are managed efficiently.

After acquiring the underlying asset, the strategy transitions to selling covered calls to generate additional income. For instance, if SPY shares are owned at $445.50, the trader may sell a $450 call option for $2.50. If SPY rises above $450 at expiration, the shares are sold at the strike price, locking in a profit that includes both the premium and the capital gain. If the call expires OTM, the trader retains both the shares and the premium, continuing to generate income in subsequent weeks.

This adaptability extends to all ETFs in the portfolio. For example, GLD provides stability and is particularly effective in sideways or declining equity markets. Selling put options on GLD during such periods can still yield steady premiums, and if assigned, selling covered calls on gold adds another layer of income. Similarly, IBIT’s higher volatility offers elevated premiums, making it a valuable component for boosting returns in volatile market conditions.

The strategy benefits significantly from time decay (theta), particularly in sideways markets. Short-dated options lose value quickly as expiration approaches, allowing the strategy to capture maximum premium within a short timeframe. This ensures steady income even in periods of minimal price movement, as the rapid decay works in the trader’s favour.

Diversification is a cornerstone of the strategy’s effectiveness. SPY, QQQ, and IWM provide exposure to U.S. equities, representing different market segments, while GLD and IBIT add defensive and high-growth elements, respectively. This mix ensures that the portfolio is well-balanced, with each ETF contributing unique strengths that offset potential weaknesses in other areas.

The inclusion of short-term expiries also limits exposure to unexpected market shifts. By resetting positions weekly, the strategy avoids prolonged exposure to adverse conditions while maintaining flexibility to adjust to new opportunities. This approach ensures consistent performance and provides peace of mind for investors seeking steady returns.

In summary, the Private Wealth Platinum strategy combines disciplined options selling, diversification, and adaptability to generate reliable weekly income. Whether through put selling, covered calls, or managing ITM scenarios, the strategy delivers consistent results across a range of market environments, offering a hands-off, professionally managed solution for steady portfolio growth.

5. Examples

The strategy consists of several rules for deciding when to buy (enter) or sell (exit) stocks. These rules are based on technical indicators, primarily focusing on the Average True Range indicator (ATR) and the Relative Strength Indicator (RSI).

Scenario 1: Bullish Market

- In a bullish market, where SPY, QQQ, IWM, GLD, and IBIT are trending upward, the strategy focuses on selling delta 0.5 put options just below the current market prices. For example, if SPY is trading at $450, the trader sells a $450 strike price put option for a premium of $4.50 per share. Similarly, with QQQ at $370, selling a $370 strike price put might yield $3.50, and with GLD at $190, a $190 strike price put could bring in $2.00 per share.

- If the ETFs close above their respective strike prices at expiration, the options expire out of the money (OTM), allowing the trader to retain the entire premiums. For SPY, this would mean keeping the $4.50 per share without having to purchase the ETF. This process is repeated weekly, maximising income during an upward market trend while minimising the risk of assignment.

- The steady upward momentum ensures a high probability that options will expire OTM. In a bullish market, premiums collected from selling puts provide reliable weekly income, with the added benefit of slightly higher premiums from moderate implied volatility. The trader capitalises on these conditions to lock in consistent returns while avoiding ownership of the underlying assets.

- By focusing on short-term expirations and resetting positions weekly, the strategy benefits from frequent opportunities to collect premiums. This systematic approach ensures dependable income while taking advantage of the bullish trend across SPY, QQQ, IWM, GLD, and IBIT.

Scenario 2: Sideways Market

- In a sideways market, where the ETFs fluctuate within a narrow range, the strategy benefits from time decay. For instance, with SPY hovering around $450, selling a $450 strike price put might yield a premium of $4.00 per share. Similarly, QQQ trading near $370 might result in a $3.00 premium for a $370 strike price put, while GLD at $190 could generate a $1.80 premium for a $190 strike price put.

- If these ETFs remain stable or slightly above their respective strike prices at expiration, the options expire OTM, and the trader retains the full premiums. Even if an ETF closes slightly below the strike price, the collected premium offsets part of the potential loss, reducing the overall risk of the trade.

- Time decay, or theta, works significantly in the trader’s favour in a sideways market. Since short-dated options lose value quickly as expiration approaches, the strategy captures maximum premium within a short timeframe. This ensures consistent returns even when the market lacks clear direction or strong trends.

- By targeting ETFs like SPY, QQQ, and GLD, which exhibit lower volatility in sideways conditions, the strategy provides a steady income stream. Frequent expirations allow the trader to reset positions weekly, maintaining a disciplined approach to generating income regardless of market stagnation.

Scenario 3: Bearish Market

- In a bearish market, where SPY, QQQ, IWM, GLD, and IBIT are declining, the strategy adapts to take advantage of elevated implied volatility (IV), which increases option premiums. For example, if SPY drops to $440, selling a $435 strike price put might yield a $6.50 premium. Similarly, QQQ at $360 could result in a $5.00 premium for a $355 strike price put, and GLD at $185 might generate a $3.50 premium for a $180 strike price put.

- If the ETFs close below their strike prices at expiration, the options finish in the money (ITM), and the trader purchases the shares at the strike prices. The premiums collected reduce the effective purchase prices, providing a cushion against the market decline. For example, acquiring SPY at $435 with a $6.50 premium reduces the effective cost to $428.50 per share.

- Once the shares are owned, the strategy transitions to selling delta 0.3 covered calls to generate additional income. For instance, selling a $440 strike price call on SPY might yield another $4.00 per share. If SPY stabilises or rebounds slightly, the shares may be called away at $440, locking in a net gain that includes both the premium and the sale price above the effective cost.

- This dynamic adjustment ensures the strategy remains resilient in bearish conditions. Elevated premiums from increased IV provide additional income, while transitioning to covered calls allows the trader to continue generating returns even in a declining market. By leveraging these adjustments, the strategy turns market volatility into an opportunity for consistent income.

The Private Wealth Platinum strategy is a premium options trading approach designed to generate consistent weekly income through a diversified portfolio of ETFs, including SPY, QQQ, IWM, GLD, and IBIT. By strategically selling options, this strategy combines the growth potential of equities, the stability of gold, and the high returns of Bitcoin to provide a balanced, reliable income stream. Its disciplined, hands-off structure allows investors to earn steady returns while mitigating risk effectively.

What sets Private Wealth Platinum apart is its adaptability to various market conditions. Whether markets are bullish, bearish, or sideways, the strategy adjusts dynamically, leveraging premium income from options selling and transitioning to covered calls when necessary. With short-term expirations and a focus on diversification, this approach ensures consistent performance, even during periods of volatility, while protecting against major losses.

Take the next step toward consistent income and diversified growth with Private Wealth Platinum. Let our team of experts guide you through this proven strategy, ensuring steady returns and peace of mind. Sign up today to experience the benefits of professionally managed options trading and start building your financial future!