HOLD THE STRIKE

Discover how you can make regular and consistent weekly income , whilst being totally hands off with your trading account.

REGULAR AND CONSISTENT WEEKLY INCOME

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

Hold the Strike

Offering leveraged returns and total diversification, this is an opportunity for MTA to execute the Hold the Strike strategy for you.

Our mission is to help our clients gain exposure to the stock market, without having to do any of the heavy lifting themselves. Best part – there are no joining fees and you can have the opportunity to have a professionally built strategy executed on your account.

1. Introducing Hold the Strike

With this strategy, you can sell options on exchange traded funds (ETFs) and receive a weekly premium in the order of around 1-3% plus. We'll guide you through the concept of options selling and show you how to consistently receive a weekly premium, pretty much all year round.

The strategy involves selling put options and then, once assigned, the ownership of shares coupled with selling call options also known as a Covered Call. This can be applied to almost any stock or ETF, but we’ll focus on the TQQQ in this strategy guide. This is the geared Nasdaq ETF, which given its liquidity and volatility make it an ideal underlying instrument for Hold the Strike.

Selling puts can be less volatile and offer some downside protection compared to outright ownership of the underlying asset. The allure of this strategy comes from pocketing extrinsic value, also known as time value, which varies with the strike, expiry, and volatility. On average, the weekly extrinsic premium for at-the-money puts with average volatility and weekly expiry is around 2% to 4%+ of the underlying price on TQQQ, based on current levels.

Using the 3% as the weekly income, as our example, if the market remains flat for a year, you have an ability to keep generating significant potential income. Of course, potential losses incurred from market drops need to be considered, but the income from the options will provide a very healthy cushion and can help absorb those losses.

If you are ready to learn and earn more from the “Hold the Strike” strategy and start generating weekly income, then read the information below.

| Hold the Strike | Details |

|---|---|

| Minimum Investment | US$15,000 |

| Market | TQQQ |

| Strategy Type | Option Selling |

| Average Trade Length | 1 Week |

| Leverage | 3xLeveraged |

| Suggested Portfolio Allocation | <10% |

2. What is the TQQQ ETF?

The TQQQ ETF is a specialized exchange-traded fund designed to track the performance of the NASDAQ-100 Index, which includes the 100 largest non-financial companies on the NASDAQ stock exchange. Distinctively, it employs a 3x leverage strategy, aiming to triple the daily returns of its underlying index, thus offering both heightened potential returns and increased volatility. This leverage makes the TQQQ ETF an attractive option for investors seeking to maximize returns from their high-risk investment capital through the strategic use of options in volatile market conditions. However, its amplified volatility also means it carries a higher risk of significant losses, positioning it as a suitable choice for the high-risk segment of an investment portfolio. Key Points:

KEY POINTS:

1

Tracks NASDAQ-100 Index:

Focuses on the 100 largest non-financial companies listed on the NASDAQ.

2

3x Leverage:

Aims to triple the daily performance of the NASDAQ-100 Index, increasing both potential gains and risks.

3

Increased Volatility:

Due to its leverage, it exhibits higher volatility compared to non-leveraged ETFs.

4

Investment Strategy:

Ideal for investors with high-risk tolerance looking to maximize potential returns in a volatile market.

5

Use of Options:

Offers an opportunity for investors with small to medium-sized accounts to leverage options for enhanced returns.

6

Risk and Reward:

While it may deliver high returns, it also poses a risk of significant losses, making it suitable for only the high-risk portion of an investor’s portfolio.

3. Strategic Considerations

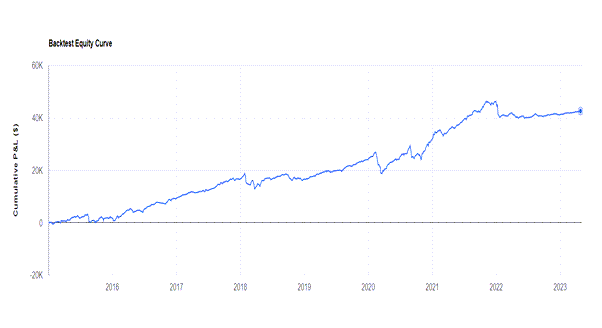

The "Hold the Strike" strategy, introduced by My Trading Advisor (MTA), presents a nuanced approach to options trading, specifically focusing on leveraging the volatility and liquidity of ETFs like the TQQQ. This leveraged Nasdaq ETF is the cornerstone of the strategy, providing an ideal playground for options traders due to its significant movements and potential for substantial premiums. At the heart of the strategy is the selling of put options, allowing traders to earn a consistent weekly premium, which can range from 1-3% or more. This method capitalises on the extrinsic value of options, which is influenced by the volatility and expiry period of the underlying asset, offering a compelling way to generate income from the market's natural ebb and flow.

However, it’s crucial to understand that with higher potential returns comes increased risk, especially given the inherent volatility of a leveraged ETF like TQQQ. The strategy is designed for the higher-risk portion of an investor’s portfolio, emphasising the importance of risk management and strategic adjustment based on market conditions. Whether the market trends upwards, downwards, or sideways, the “Hold the Strike” approach advocates for flexibility in choosing strikes for put selling—be it out-of-the-money, at-the-money, or in-the-money—highlighting the dynamic nature of market movements and the need for continuous adaptation.

Moreover, in the event of a market downturn leading to stock assignment, the strategy suggests a shift to selling out-of-the-money calls. This maneuver aims to mitigate losses and potentially recover through strategic strike selections, thereby maximising income while minimising the impact of losses. By employing this strategy, traders engage in a disciplined and patient approach, aiming to recover any loss of intrinsic value during market drops with the eventual bounce back. This strategic framework underscores the potential to achieve higher returns over the long run by carefully managing risk and capitalising on market volatility, making it a valuable strategy for those willing to navigate the higher risks for potentially greater rewards.

4. How Does the Strategy Work?

To begin with, it’s crucial to grasp that market conditions are inherently unstable and can fluctuate in unexpected ways. The notion that markets maintain a consistent trajectory—whether flat, ascending, or descending—is a misconception. In reality, market movements are dynamic, often experiencing upward, downward, or even erratic shifts characterized by sudden bursts of volatility.

Understanding the foundational principle of trading strategy is key, emphasizing the difficulty for traders to accurately forecast market trends. For example, despite a prevailing bullish trend, markets can still witness significant downturns. Thus, the success of any investment strategy hinges on effectively navigating both the ups and downs, as well as the general market trend.

In the context of options trading, specifically when selling puts, the choice between out-of-the-money (OTM), at-the-money (ATM), or in-the-money (ITM) positions significantly influences investment outcomes. Opting for ATM put selling involves renewing the put at its current price upon each expiration or, alternatively, acquiring the stock and selling ATM calls. This approach requires adjusting the strike price upwards if the market rises and downwards if it declines.

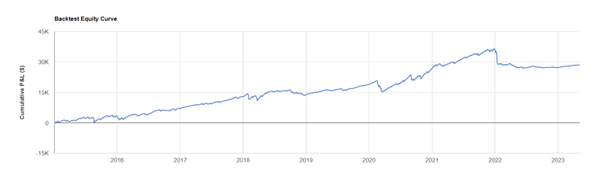

However, this strategy, while seemingly straightforward, comes with its challenges. For instance, an analysis of the performance of selling ATM options on TQQQ since 2015 reveals that this strategy, despite being less volatile than TQQQ itself, faced significant losses during market downturns.

The performance can be attributed to its susceptibility to volatility swings, causing it to be “whip-sawed” in up/down markets. To avoid this, investors considering TQQQ may need to supplement their positions after a drop.

Therefore, while selling puts ATM can seem like a straightforward strategy, it’s important to understand the potential risks and drawbacks. Proper management of up and down swings, market direction, and volatility can greatly impact your investment performance.

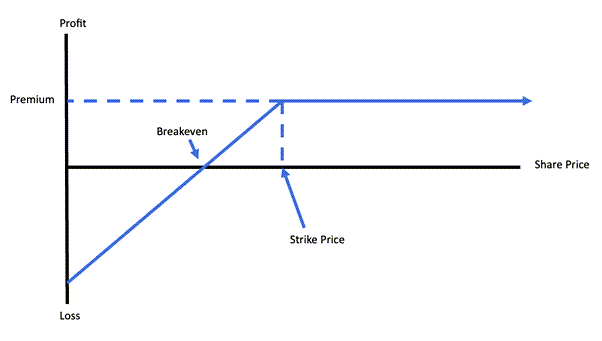

Let’s start with the basics. When you sell a put option, you receive a premium credited to your account, in exchange for agreeing to buy the underlying stock at a specified price (the strike price) if the stock falls below that price by the expiration date. If the stock stays above the strike price, the option expires worthless, you keep all the premium and simply repeat the process again.

Now, you might be thinking, “But what if the market goes down, I’m forced to buy the stock at the strike price of my sold put, but the share price is lower so I am in a loss?” That’s where strategy comes into play. Once you hold the stock after being assigned on the initial sold put options, instead of selling at-the-money calls (i.e., at the current stock price), consider selling out of-the-money calls. This means if the stock does go down further, you’ll still be able to subsidise the loss by the amount of the call premium received, but if it rallies you receive both the call option premium plus a gain on the stock up to the strike price of your sold option, thus recouping some, if not all the previous loss.

The equity for selling In the Money options when the market is declining is shown below:

This is where the “hold the strike” strategy is superior to simply selling ATM options. If the stock does drop, instead of chasing the stock price down by selling a new call (or put) option at the money, we keep selling higher strike price options until the loss on the stock is recouped, after which we sell ATM options again. This may mean sacrificing some extrinsic value (the portion of the option premium that is not tied to the stock price) but it allows you to avoid being “whipsawed” and losing too much intrinsic value (the portion of the option premium tied to the stock price).

Let’s run through some examples below:

5. Examples

The strategy consists of several rules for deciding when to buy (enter) or sell (exit) stocks. These rules are based on technical indicators, primarily focusing on the Average True Range indicator (ATR) and the Relative Strength Indicator (RSI).

Scenario 1: Bullish Market

- Let’s say you sell the closest ATM (at-the-money) put on TQQQ with a strike price of $30.00 when TQQQ is trading at $29.95. The premium you receive is $2 per share. If TQQQ continues to rise and remains above $30.00 until the expiration date, you keep the premium and the put expires worthless.

- However, if TQQQ drops below $30 and you get assigned the stock for $30.00 but taking into account the received premium of $2.00, your breakeven is now actually $28 ($30 assignment of the stock less the income you have earned of $2.00) meaning you are only in a loss if TQQQ is trading below $28.00. You should hold the strike and sell a covered call with a strike price of $30, if possible, instead of chasing the strike price down for your sold call.

- If TQQQ has dropped substantially, let’s say by more than 5%, rather than selling the call option with a $30.00 strike, you would sell an out of the money call option 3 to 6%+ above where TQQQ is trading. By selling the option and creating a TQQQ covered call, you can collect additional premium and potentially make up for some of the losses, if not all the loss on the stock. You can continue to hold the covered call until expiry, and if the call expires worthless then sell another call at 3-6% above the TQQQ stock price.

- Once assigned on the sold call and back in cash you would then check your account for one of two things, firstly if TQQQ is back above $30 start selling ATM puts, if TQQQ is below $30 sell an in the money put 3-6% above the TQQQ stock price.

Scenario 2: Sideways Market

- In a sideways market, TQQQ fluctuates around its current price and closes either slightly above or below the strike price of your sold put. In this case, you continue to sell ATM puts on TQQQ, if it finished above you collect the put premium before repeating the process and selling another put.

- If TQQQ drops and you get assigned, you should sell a call option at a strike price the same as the price at which you bought the stock. You would then keep selling call options until you are exercised, after which you would resume selling put options.

Scenario 3: Bearish Market

- In a down market, TQQQ drops below the strike price of your put and you get assigned. However, instead of chasing the stock down and selling at a lower strike price, you should hold the strike and sell a covered call at the same strike price as where you were assigned.

- If the price dropped significantly, you would sell an out of the money call 3-6% above the current price. The covered call will generate additional income and help you recover some of your losses.

- If TQQQ continues to drop and the covered call expires worthless, you would continue to hold the stock and sell another covered call 3-6% above the current price of TQQQ until assigned. You would then sell in the money put options 3-6% above the stock price until the loss is recouped.

In conclusion, the Hold the Strike strategy can be a powerful tool in a market where there is both upside potential and downside risk. By being disciplined and patient, investors can recover all or part of any loss of intrinsic value that occurs on a drop when the inevitable bounce occurs. This means that the investor can potentially earn higher returns over the long run by sacrificing some extrinsic value in exchange for reducing the risk of being caught in a “whipsaw” market.

If you’re looking for a way to maximise your options trading returns while reducing your risk compared with holding an underlying stock, Hold the Strike strategy may be a valuable inclusion in your trading plan.

To have this strategy executed for you on your trading account please select the ‘Sign Up Now” button below to proceed. On the next page you will be asked for your name, email and phone number. We will check to see if you have an existing account, if so we will send you our Strategy Execution Agreement. If not we will help you to open an account with Interactive Brokers, which will be linked to MTA so we are able to execute trade on your account once funded.