Stock Strategies

Discover how you can grow your portfolio with a selection of stock trading systems that allow profits to run whilst managing downside risk

CHOOSE FROM OUR RANGE OF STOCK SYSTEMS BELOW

- What is Share Trading01

- Key Features of Share Trading02

- Trade Both Long and Short03

- Calculating Profits and/or Losses04

- Share Trading Examples05

- Key Benefits of Shares06

- Margin Lending07

- Risks of Share Trading08

- Styles of Share Trading09

- Tools & Resources10

- How to Open an Account11

- Supported Brokers12

List of Strategies

Navigate down the page using the buttons below to view each strategy.

1. RSI-4

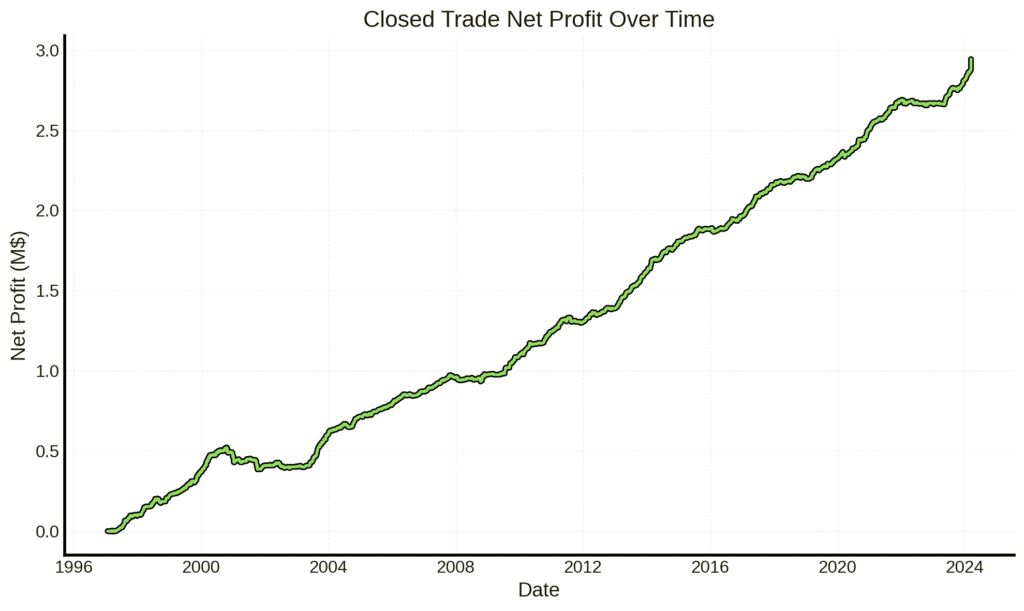

RSI-4 is the shortest term stock system we offer with trades lasting several weeks on average

The RSI-4 strategy offers a streamlined approach to trading Nasdaq100 stocks, focusing on buying oversold markets for short-term rallies. Trades typically last about a month, aiming to capitalise on quick market movements, regardless of the overall market direction. This strategy provides a disciplined way to engage with volatile markets, identifying potential buying opportunities in dips and selling when modest gains are achieved. It’s designed for those looking to efficiently navigate the stock market’s ups and downs with a methodical, data-driven approach. Explore this strategy further by clicking the View Strategy button below.

2. PRIUS

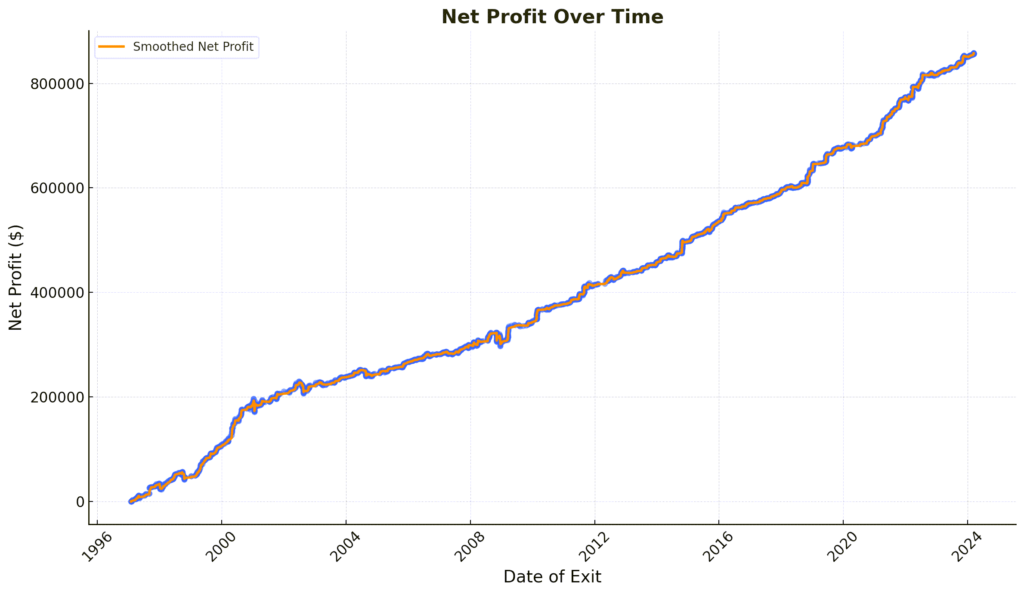

Take advantage of a range of market conditions with Prius, combining trend following with mean reversion.

The Prius System blends short-term and medium-term trading strategies into a comprehensive method, suitable for those seeking a structured approach to the markets. It incorporates technical analysis, using indicators like RSI and ATR, to identify entry and exit points, optimizing trade timing for profitability. With trades lasting from one month to potentially years, it adapts to various market conditions, including trends and volatility. This system is ideal for traders aiming for informed, data-driven decisions to navigate market movements efficiently. Discover the detailed methodology and start trading with precision by clicking the “View Strategy” button.

3. BREAKOUT ASX

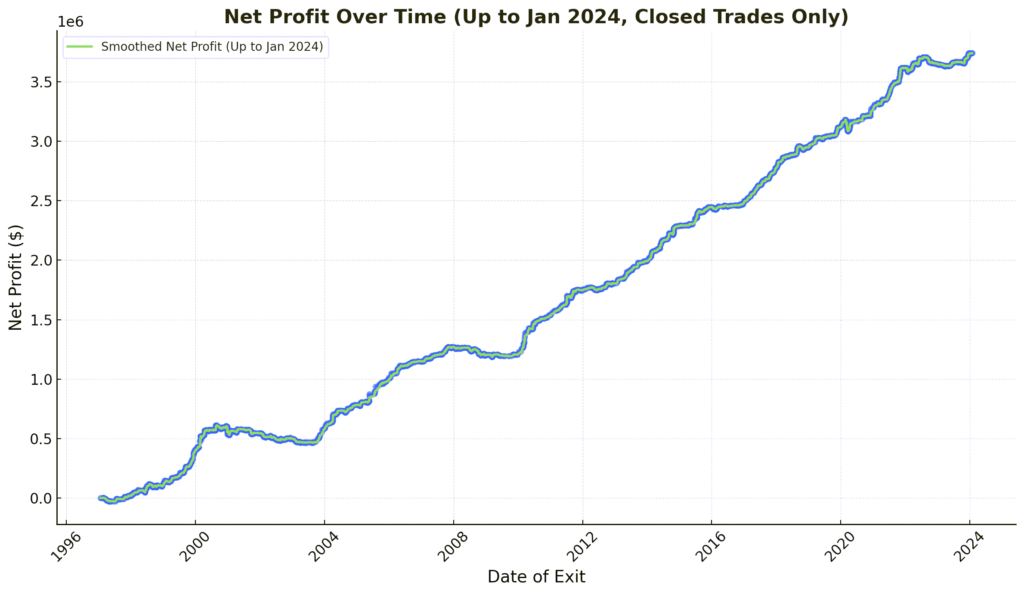

A classic trend following strategy Breakout enters on new highs following trends and managing risk.

Breakout is a trend following strategy that enters the market during an uptrend, prior to running a dynamic stop loss and profit target which results in winning traders being larger than losing trades. Traded on the shares that comprise the ASX 200 index this trend following strategy looks to manage risk in down markets by avoiding trades whilst taking advantage of bull markets when stocks are running higher. The strategy takes advantage of channel breakout techniques for entry and utilises average true range to determine exit points based on volatility. Click View Strategy below for more information.

4. PINNACLE 100

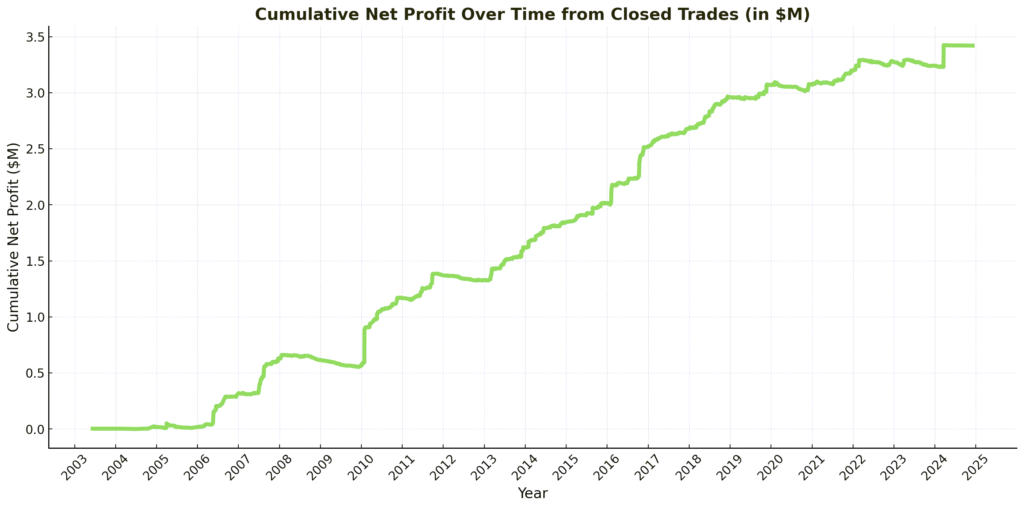

Entering during oversold markets Pinnacle aggressively manages risk whilst letting profits run.

The Pinnacle 100 System offers a straightforward approach to trading stocks on the Nasdaq 100 Index, focusing on short to medium-term gains from oversold conditions. Utilising indicators like RSI and ATR, it provides clear entry and exit points for both uptrends and downtrends. This fully mechanical strategy simplifies trading—our agreement enables us to handle trade executions, requiring minimal effort from you.

Designed for traders seeking a data-driven method with a strong emphasis on risk management, the Pinnacle 100 System minimises daily trading decisions. Ready for a structured trading strategy that works for you? Click View Strategy to get started.